Best Travel Rewards Credit Card : Selecting the quality travel rewards credit score card can considerably beautify your journey experiences whilst offering precious perks and blessings. These playing cards offer rewards including airline miles, hotel factors, and flexible tour credit that can be redeemed for flights, inn remains, condo cars, and greater. One of the important thing blessings of tour rewards credit score cards is their capacity to earn rewards on ordinary purchases, allowing cardholders to accumulate points or miles quickly and redeem them for tour-associated fees.

- Defination Of Best Travel Rewards Credit Card

- Importance of Best Travel Rewards Credit Card

- Here Is The List Of 20 Best Travel Rewards Credit Card

- 20 Best Travel Rewards Credit Card

- 1. Chase Sapphire Preferred® Card (Best Travel Rewards Credit Card)

- 2. Chase Sapphire Reserve®

- 3. American Express® Gold Card

- 4. The Platinum Card® from American Express (Best Travel Rewards Credit Card)

- 5. Capital One Venture Rewards Credit Card

- 6. Capital One Venture X Rewards Credit Card

- 7. Citi Premier® Card

- 8. Citi Prestige® Card (Best Travel Rewards Credit Card)

- 9. Discover it® Miles

- 10. Bank of America® Travel Rewards Credit Card

- 11. Barclays Arrival® Premier World Elite Mastercard® (Best Travel Rewards Credit Card)

- 12. Wells Fargo Propel American Express® Card

- 13. Marriott Bonvoy Boundless™ Credit Card

- 14. Marriott Bonvoy Brilliant™ American Express® Card

- 15. Hilton Honors American Express Surpass® Card

- 16. World of Hyatt Credit Card (Best Travel Rewards Credit Card)

- 17. IHG® Rewards Premier Credit Card

- 18. Southwest Rapid Rewards® Premier Credit Card

- 19. United℠ Explorer Card (Best Travel Rewards Credit Card)

- 20. Delta SkyMiles® Gold American Express Card

- Benefits of Best Travel Rewards Credit Card

- Conclusion : Best Travel Rewards Credit Card

- FAQ’S : Best Travel Rewards Credit Card

- What is a journey rewards credit card?

- How do journey rewards credit score playing cards work?

- What are the blessings of a travel rewards credit score card?

- How do I choose the quality tour rewards credit card for me?

- What kinds of rewards can I earn with a journey rewards credit score card?

- Do travel rewards credit score cards have annual charges?

- Are journey rewards credit score cards worth it?

- Can I use a journey rewards credit score card for regular purchases?

The first-class tour rewards credit score cards typically include beneficiant signal-up bonuses, which regularly require meeting a minimum spending requirement inside a specific time frame. These bonuses can offer a enormous increase on your tour rewards stability, permitting you to redeem rewards faster at no cost or discounted journey.

Additionally, many journey rewards credit cards offer top rate perks and blessings that enhance the overall travel revel in. These perks can also consist of airport living room get admission to, precedence boarding, loose checked bags, tour insurance coverage, concierge services, and statement credit for tour-related prices which include luggage prices or Global Entry/TSA PreCheck utility prices.

Furthermore, a few tour rewards credit score cards offer flexibility in how rewards may be redeemed, allowing cardholders to transfer factors or miles to numerous airline and lodge loyalty applications, maximizing their redemption cost. Others may additionally offer fixed-fee points or miles that can be redeemed directly for journey purchases at a hard and fast fee, imparting simplicity and ease of use.

Overall, the pleasant travel rewards credit card is one that aligns along with your travel options, spending habits, and financial desires even as presenting precious rewards, perks, and benefits that decorate your travel reviews and offer notable price in your cash. By carefully comparing the functions and benefits of various journey rewards credit score playing cards, you may locate the card that nice fits your needs and helps you acquire your travel aspirations.

Defination Of Best Travel Rewards Credit Card

The first-class travel rewards credit card is a monetary tool designed to offer cardholders treasured advantages, perks, and rewards that enhance their tour reports. These cards commonly earn factors or miles on each purchase, with better incomes quotes for journey-associated expenses together with airfare, resorts, eating, and transportation. The accumulated points or miles can then be redeemed for diverse tour-related rewards, together with flights, motel stays, rental automobiles, excursion packages, and more.

Key features of the best journey rewards credit cards include beneficiant signal-up bonuses, which regularly provide a large quantity of factors or miles after meeting a minimum spending requirement inside a specific time frame. These bonuses serve as an amazing incentive for brand spanking new cardholders and can soar-start their journey rewards balance.

Moreover, the pleasant journey rewards credit cards provide top class perks and blessings that cater to common vacationers. These perks can also encompass airport lounge get entry to, priority boarding, unfastened checked bags, travel coverage insurance, concierge services, and assertion credit for tour-related prices. By supplying access to one-of-a-kind advantages and privileges, these cards increase the general travel enjoy and provide added cost to cardholders.

Furthermore, flexibility is a trademark of the great travel rewards credit playing cards. Many playing cards allow cardholders to redeem points or miles with a huge variety of airline and motel companions, imparting flexibility and maximizing the cost in their rewards. Additionally, some cards provide the choice to redeem factors or miles for assertion credits towards travel purchases, imparting simplicity and convenience in redemption options.

In precis, the first-rate travel rewards credit score card is one that offers aggressive earning charges, generous sign-up bonuses, top class perks and benefits, and flexibility in redemption options. By leveraging these capabilities, cardholders can earn treasured rewards, enjoy extraordinary privileges, and beautify their tour reports even as maximizing the value in their spending.

Importance of Best Travel Rewards Credit Card

The significance of choosing the exceptional travel rewards credit score card cannot be overstated for avid travelers and people trying to maximize the fee of their spending. A properly-chosen tour rewards credit card can significantly enhance one’s travel stories at the same time as providing treasured perks and blessings which could make a tremendous difference in normal financial savings and comfort.

Firstly, the pleasant journey rewards credit score playing cards offer possibilities to earn points or miles on regular purchases, that could then be redeemed for travel-associated prices including flights, resorts, apartment cars, and more. This manner that cardholders can basically earn rewards on their everyday spending, permitting them to build up points or miles through the years and redeem them for full-size savings on tour expenses.

Moreover, many tour rewards credit score cards come with lucrative signal-up bonuses, offering a sizeable number of points or miles to new cardholders who meet a minimum spending requirement within a specified time-frame. These signal-up bonuses can offer an instantaneous enhance to 1’s rewards stability, making it less complicated to have enough money flights, accommodations, or different tour prices.

Additionally, the pleasant journey rewards credit score cards frequently include top class perks and blessings that cater to frequent travelers. These perks might also include airport living room get right of entry to, precedence boarding, loose checked bags, journey coverage coverage, concierge offerings, and announcement credit for tour-associated charges. These blessings not simplest beautify the overall journey enjoy however also offer delivered fee and convenience for cardholders.

Furthermore, flexibility is a critical thing of the nice tour rewards credit score playing cards. Many cards allow cardholders to redeem points or miles with a number of airline and resort companions, presenting flexibility and maximizing the fee in their rewards. This way that cardholders can select the journey options that best suit their alternatives and desires, whether it’s a luxury lodge stay or an global flight.

In conclusion, the importance of the first-rate journey rewards credit score card lies in its capacity to offer valuable rewards, perks, and blessings that decorate the general journey enjoy at the same time as imparting big savings and convenience for cardholders. By choosing a travel rewards credit score card that aligns with one’s tour possibilities and spending behavior, vacationers can maximize their rewards earnings, experience extraordinary privileges, and make the most in their journey reports.

Here Is The List Of 20 Best Travel Rewards Credit Card

- Chase Sapphire Preferred® Card (Best Travel Rewards Credit Card)

- Chase Sapphire Reserve®

- American Express® Gold Card

- The Platinum Card® from American Express (Best Travel Rewards Credit Card)

- Capital One Venture Rewards Credit Card

- Capital One Venture X Rewards Credit Card

- Citi Premier® Card

- Citi Prestige® Card (Best Travel Rewards Credit Card)

- Discover it® Miles

- Bank of America® Travel Rewards Credit Card

- Barclays Arrival® Premier World Elite Mastercard® (Best Travel Rewards Credit Card)

- Wells Fargo Propel American Express® Card

- Marriott Bonvoy Boundless™ Credit Card

- Marriott Bonvoy Brilliant™ American Express® Card

- Hilton Honors American Express Surpass® Card

- World of Hyatt Credit Card (Best Travel Rewards Credit Card)

- IHG® Rewards Premier Credit Card

- Southwest Rapid Rewards® Premier Credit Card

- United℠ Explorer Card (Best Travel Rewards Credit Card)

- Delta SkyMiles® Gold American Express Card

20 Best Travel Rewards Credit Card

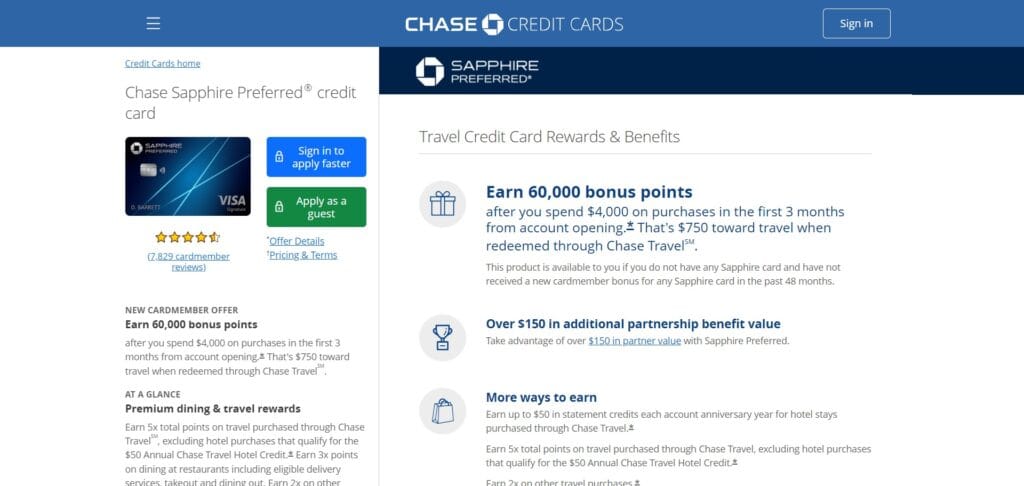

1. Chase Sapphire Preferred® Card (Best Travel Rewards Credit Card)

The Chase Sapphire Preferred® Card is a stellar preference for vacationers looking for versatility and price. With its generous rewards application, cardholders earn points on every purchase, with bonus points for dining and tour prices. What sets this card apart is its flexibility in redeeming factors; users can switch factors to severa airline and motel partners at a 1:1 ratio, maximizing the fee of their rewards.

Additionally, the card offers treasured travel advantages which includes ride cancellation/interruption insurance, condo automobile coverage, and no foreign transaction expenses. The smooth metal layout provides a touch of class in your pockets, while the strong rewards program guarantees memorable travel reviews with every swipe.

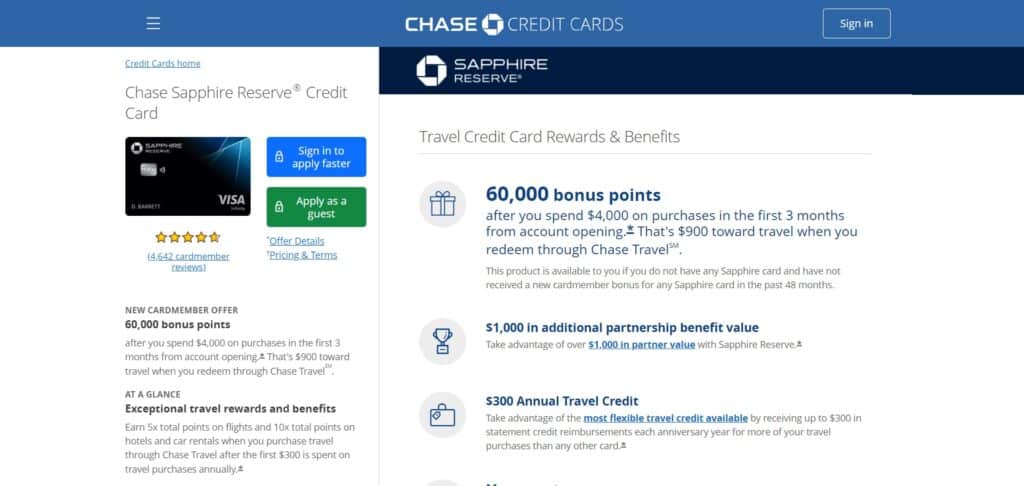

2. Chase Sapphire Reserve®

For the discerning tourist who seeks premium perks and unprecedented rewards, the Chase Sapphire Reserve® stands out as an elite preference. With a hefty annual fee, this card caters to frequent travelers with its considerable list of advantages. Cardholders experience airport front room access via Priority Pass Select, a treasured perk for long layovers or not on time flights.

Additionally, the cardboard gives a $300 annual travel credit score, Global Entry or TSA PreCheck fee repayment, and comprehensive journey coverage coverage. Earning factors is easy, with triple factors on tour and dining purchases. Plus, like its sibling, the Sapphire Preferred, points can be transferred to numerous travel companions at a 1:1 ratio, making sure maximum value in your redemptions. The Chase Sapphire Reserve® epitomizes luxury and comfort, making it a pinnacle preference for tourists who demand the fine.

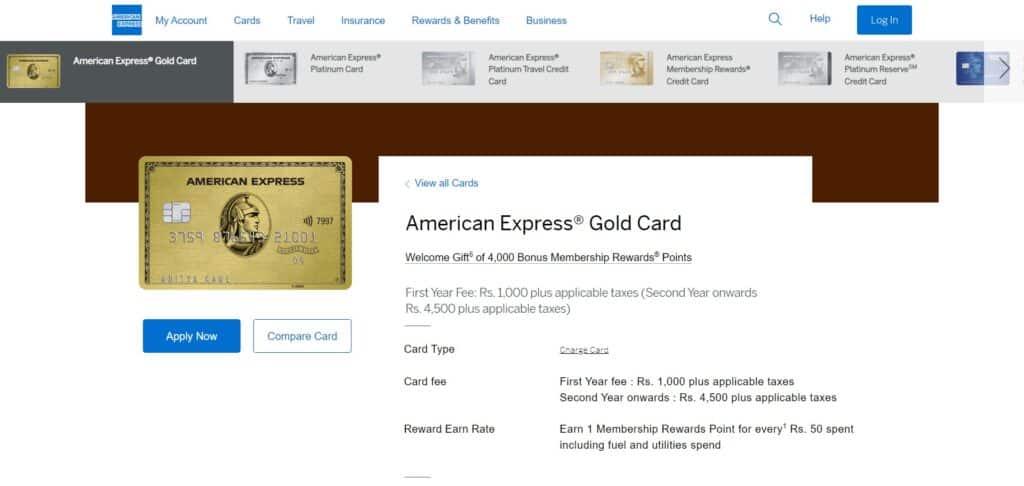

3. American Express® Gold Card

The American Express® Gold Card is a favourite amongst foodies and tourists alike, imparting generous rewards on eating and groceries, as well as select journey purchases. With a stunning metal layout, this card exudes sophistication and style.

Cardholders earn Membership Rewards factors fast, with 4X points at restaurants global and U.S. Supermarkets, and 3X factors on flights booked at once with airlines or on amextravel.Com. Furthermore, the cardboard presents up to $one hundred twenty in eating credits yearly at choose eating places and up to $100 airline fee credit in line with calendar 12 months. While it could no longer provide as sizable travel perks as a few top rate playing cards, the American Express® Gold Card is perfect for individuals who prioritize earning rewards on normal spending and indulging in culinary studies during their travels.

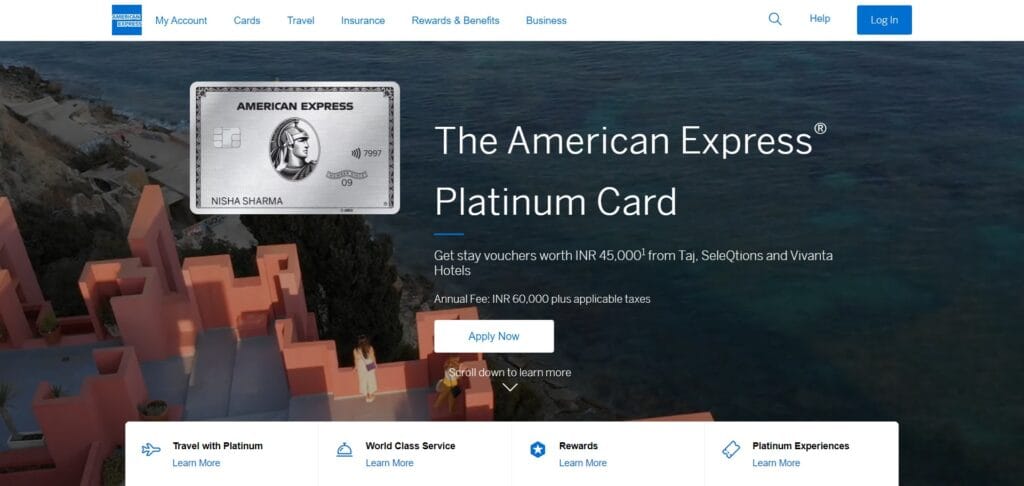

4. The Platinum Card® from American Express (Best Travel Rewards Credit Card)

As the pinnacle of luxury tour cards, The Platinum Card® from American Express gives an unrivaled suite of advantages and perks. While the hefty annual fee may also deter some, the card’s big list of blessings greater than justifies the price for common tourists.

Cardholders revel in get admission to to exceptional airport lounges worldwide, inclusive of Centurion Lounges, Priority Pass Select, and Delta Sky Clubs (while flying Delta). Additionally, the card gives up to $two hundred in Uber credit annually, up to $2 hundred airline rate credit score, and up to $a hundred in Saks Fifth Avenue credit. Earning points is equally rewarding, with 5X factors on flights booked at once with airways or with American Express Travel, and 5X points on eligible lodges booked on amextravel.Com. While The Platinum Card® isn’t always for the informal tourist, its good sized benefits and unprecedented luxury make it a have to-have for individuals who demand the absolute first-class in journey rewards.

5. Capital One Venture Rewards Credit Card

The Capital One Venture Rewards Credit Card is a notable choice for vacationers who crave simplicity and versatility of their rewards application. With no blackout dates and no airline or lodge restrictions, redeeming rewards is a breeze. Cardholders earn limitless 2X miles on each purchase, making it smooth to rack up miles in your next journey. Plus, with the capability to switch miles to over 15 airline partners, customers have the ability to maximize the fee in their rewards. The card also gives a Global Entry or TSA PreCheck application fee credit score, at the side of travel accident coverage and no foreign transaction expenses. While it could now not provide as many bells and whistles as a few top rate playing cards, the Capital One Venture Rewards Credit Card is best for tourists who prioritize simplicity and fee of their rewards software.

6. Capital One Venture X Rewards Credit Card

The Capital One Venture X Rewards Credit Card is a game-changer for travelers looking for top rate perks and most flexibility. With its glossy metallic design and robust rewards software, this card gives exceptional advantages.

Cardholders earn unlimited 10X miles on lodges and rental motors booked via Capital One Travel and 5X miles on flights booked thru Capital One Travel, making it easy to rack up miles quick. Additionally, customers revel in up to a $300 annual journey credit score, Global Entry or TSA PreCheck fee compensation, and no overseas transaction prices. The card’s unique feature is the capacity to transfer miles to over 15 airline partners at a 1:1 ratio, starting up a international of redemption possibilities. Whether you are a common flyer or an occasional traveller, the Capital One Venture X Rewards Credit Card supplies remarkable fee and flexibility, making it a pinnacle desire for travel fans.

7. Citi Premier® Card

The Citi Premier® Card is a flexible tour rewards card that caters to a extensive range of tourists. With its beneficiant rewards program and precious advantages, this card gives splendid fee for its moderate annual charge. Cardholders earn triple factors on tour which includes gasoline stations, airfare, lodges, and dining out, in addition to double points on entertainment and at supermarkets.

Plus, points may be transferred to numerous airline companions, potentially unlocking even extra cost for savvy travelers. The card also gives a $a hundred annual inn financial savings benefit and no overseas transaction charges. While it can not provide as many top class perks as a few excessive-stop cards, the Citi Premier® Card gives strong rewards and blessings for travelers who value flexibility and affordability.

8. Citi Prestige® Card (Best Travel Rewards Credit Card)

For travelers who call for luxury and exclusivity, the Citi Prestige® Card is a pinnacle contender. With its top class blessings and wonderful rewards software, this card caters to discerning globetrotters. Cardholders enjoy an annual $250 travel credit, complimentary fourth night time at accommodations while booked through ThankYou.Com, and airport front room access via Priority Pass Select.

Additionally, the cardboard offers triple factors on air journey and accommodations, double points on dining and entertainment, and 1 factor consistent with dollar spent on all other purchases. Points can be redeemed for journey via the ThankYou Travel Center or transferred to diverse airline companions. While the cardboard comes with a hefty annual charge, its huge list of blessings and rewards make it a worthwhile investment for frequent tourists searching for luxurious experiences and top rate perks.

9. Discover it® Miles

The Discover it® Miles card is a outstanding alternative for tourists in search of simplicity and price of their rewards software. With no annual charge and unlimited 1.5X miles on every buy, earning and redeeming rewards is easy. Additionally, Discover suits all the miles you’ve earned on the stop of your first year, successfully doubling your rewards.

Miles can be redeemed as a announcement credit score toward travel purchases, imparting most flexibility. Furthermore, the cardboard comes and not using a foreign transaction expenses and consists of numerous journey and purchase protections. While it can now not offer as many top class perks as some different journey cards, the Discover it® Miles card is ideal for finances-conscious tourists who want to earn rewards on everyday spending without any problem.

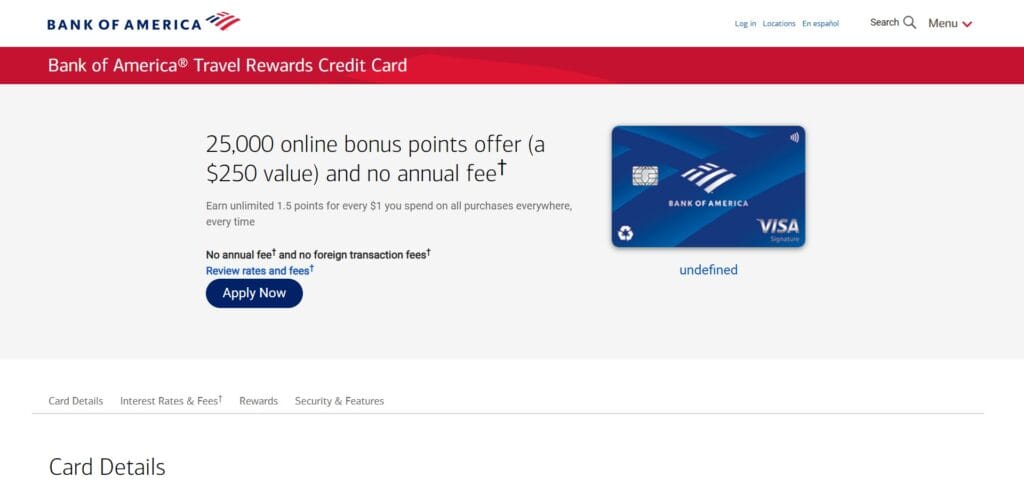

10. Bank of America® Travel Rewards Credit Card

The Bank of America® Travel Rewards Credit Card is an brilliant choice for vacationers who want to earn rewards on their purchases without annoying approximately an annual rate. With unlimited 1.5X points on each purchase, cardholders can quickly gather points for their next adventure. Plus, in case you’re a Bank of America Preferred Rewards member, you can earn even more factors.

Redeeming factors is straightforward, as they can be used to e book tour thru the Bank of America Travel Center or redeemed as a statement credit score toward tour purchases. The card additionally comes with no overseas transaction costs and includes numerous travel and buy protections. While it can now not provide as many bells and whistles as some top rate journey playing cards, the Bank of America® Travel Rewards Credit Card offers strong rewards and advantages for vacationers seeking out a sincere and value-effective way to earn rewards on their spending.

11. Barclays Arrival® Premier World Elite Mastercard® (Best Travel Rewards Credit Card)

The Barclays Arrival® Premier World Elite Mastercard® offers a wealth of blessings and rewards for frequent vacationers. With its emphasis on simplicity and versatility, this card is ideal for those who fee trouble-free tour rewards. Cardholders earn limitless 2X miles on each purchase, with the possibility to earn up to twenty-five,000 anniversary miles each 12 months based totally on spending. Miles may be redeemed for tour announcement credit, making it smooth to offset tour fees.

Additionally, the card gives treasured journey perks including Global Entry or TSA PreCheck fee compensation, no overseas transaction costs, and access to Mastercard’s luxurious journey experiences. While it could lack a number of the premium perks of other high-quit tour cards, the Barclays Arrival® Premier World Elite Mastercard® is best for vacationers who prioritize simplicity and value of their rewards software.

12. Wells Fargo Propel American Express® Card

The Wells Fargo Propel American Express® Card is a tremendous alternative for price range-conscious vacationers searching for beneficiant rewards and precious advantages. With no annual price and a sincere rewards program, this card gives awesome fee for regular spending. Cardholders earn triple factors on eating, gasoline stations, rideshares, transit, flights, hotels, homestays, and vehicle rentals, in addition to one point consistent with dollar on all other purchases.

Points may be redeemed for journey, cashback, gift playing cards, and more, imparting flexibility in how you operate your rewards. Additionally, the card consists of treasured blessings inclusive of mobile cellphone protection and no overseas transaction charges. While it could no longer offer as many luxury perks as some top class tour cards, the Wells Fargo Propel American Express® Card is ideal for tourists who want to earn rewards on their normal purchases without any problem.

13. Marriott Bonvoy Boundless™ Credit Card

The Marriott Bonvoy Boundless™ Credit Card is a must-have for lovers of Marriott lodges and inns. With its beneficiant rewards program and valuable advantages, this card offers high-quality cost for common tourists. Cardholders earn up to 17X points per dollar spent at participating Marriott Bonvoy resorts, in addition to 2X factors on all different purchases.

Plus, new cardmembers can earn a big welcome bonus after meeting spending necessities. Points may be redeemed totally free nights at Marriott houses international, room upgrades, flights, and greater, providing flexibility in how you use your rewards. Additionally, the card gives precious perks which includes automated Silver Elite repute, anniversary free night awards, and no foreign transaction charges. Whether you are a unswerving Marriott guest or genuinely revel in luxury travel studies, the Marriott Bonvoy Boundless™ Credit Card is a precious addition to any traveller’s wallet.

14. Marriott Bonvoy Brilliant™ American Express® Card

The Marriott Bonvoy Brilliant™ American Express® Card is a top class travel card designed for discerning tourists who frequent Marriott inns and resorts. With its costly perks and generous rewards application, this card offers remarkable blessings for the ones looking for elite journey reports. Cardholders earn up to 6X points in step with dollar spent at taking part Marriott Bonvoy motels, in addition to 3X points at U.S. Restaurants and on flights booked at once with airlines. Plus, new cardmembers can earn a sizeable welcome bonus after assembly spending requirements. Points can be redeemed without spending a dime nights, room enhancements, flights, and extra, providing flexibility in how you use your rewards. Additionally, the card offers an annual free night award, up to $300 in declaration credits for eligible purchases at Marriott Bonvoy hotels, automatic Gold Elite popularity, Priority Pass Select club, and extra. Whether you’re a common tourist or revel in indulging in luxurious reports, the Marriott Bonvoy Brilliant™ American Express® Card gives you awesome cost and advantages.

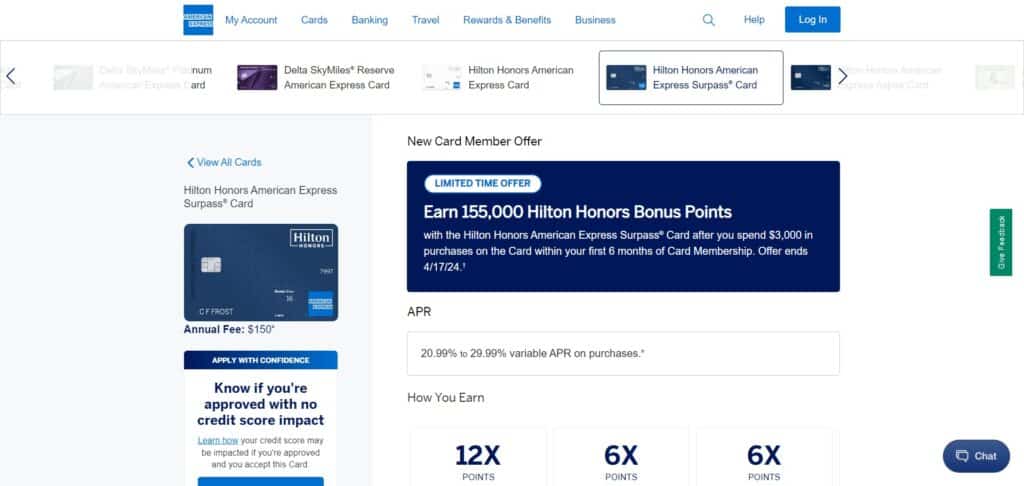

15. Hilton Honors American Express Surpass® Card

The Hilton Honors American Express Surpass® Card is a top desire for vacationers who frequent Hilton hotels and hotels. With its robust rewards software and treasured advantages, this card gives remarkable value for Hilton fans. Cardholders earn as much as 12X points according to dollar spent at Hilton properties, as well as 6X factors at U.S. Restaurants, U.S. Supermarkets, and U.S. Fuel stations.

Plus, new cardmembers can earn a giant welcome bonus after meeting spending necessities. Points may be redeemed free of charge nights, room enhancements, stories, and greater, imparting flexibility in how you operate your rewards. Additionally, the card gives complimentary Hilton Honors Gold status, Priority Pass Select club, and no overseas transaction prices. Whether you’re a unswerving Hilton guest or without a doubt enjoy luxurious journey reviews, the Hilton Honors American Express Surpass® Card is a precious addition to any vacationer’s wallet.

16. World of Hyatt Credit Card (Best Travel Rewards Credit Card)

The World of Hyatt Credit Card is a most fulfilling choice for travelers who common Hyatt resorts and accommodations. With its robust rewards application and precious benefits, this card offers wonderful cost for the ones looking for luxury resorts. Cardholders earn up to 9X points according to dollar spent at Hyatt houses, in addition to 2X points on eating, airline tickets purchased at once from airways, local transit and commuting, and fitness membership and fitness center memberships.

Plus, new cardmembers can earn a good sized welcome bonus after assembly spending requirements. Points may be redeemed without spending a dime nights, room enhancements, dining and spa reports, and greater, offering flexibility in how you use your rewards. Additionally, the card offers an annual unfastened night award, automated Discoverist status, and no overseas transaction expenses. Whether you’re a dependable Hyatt visitor or enjoy indulging in luxury tour stories, the World of Hyatt Credit Card can provide notable price and blessings.

17. IHG® Rewards Premier Credit Card

The IHG® Rewards Premier Credit Card is a pinnacle desire for travelers who common IHG hotels and motels. With its beneficiant rewards program and valuable blessings, this card gives amazing cost for the ones seeking numerous lodging options. Cardholders earn as much as 25X points according to dollar spent at IHG homes, in addition to 2X factors at fuel stations, grocery stores, and eating places, and 1X factor on all different purchases.

Plus, new cardmembers can earn a great welcome bonus after assembly spending requirements. Points can be redeemed without cost nights, room enhancements, products, and greater, supplying flexibility in how you operate your rewards. Additionally, the cardboard offers an annual loose night time award, automated Platinum Elite popularity, and no overseas transaction charges. Whether you are a loyal IHG visitor or revel in exploring quite a few motels and motels, the IHG® Rewards Premier Credit Card is a treasured addition to any traveler’s wallet.

18. Southwest Rapid Rewards® Premier Credit Card

The Southwest Rapid Rewards® Premier Credit Card is a standout desire for common vacationers who select the ability and convenience of Southwest Airlines. With its beneficiant rewards software and treasured benefits, this card gives notable cost for the ones seeking cheap and handy air travel.

Cardholders earn up to 3X factors consistent with dollar spent on Southwest purchases, as well as 2X factors on nearby transit and commuting, which include rideshares, taxis, and public transportation, and 1X point on all other purchases. Plus, new cardmembers can earn a full-size welcome bonus after assembly spending necessities. Points may be redeemed for flights, hotel remains, automobile rentals, and extra, and not using a blackout dates or seat regulations on Southwest flights. Additionally, the card offers anniversary factors, tier qualifying points towards A-List repute, and no foreign transaction fees. Whether you are a frequent flyer or experience the benefit of Southwest Airlines, the Southwest Rapid Rewards® Premier Credit Card is a precious asset for maximizing your journey rewards.

19. United℠ Explorer Card (Best Travel Rewards Credit Card)

The United℠ Explorer Card is an splendid choice for travelers who frequently fly with United Airlines and its partners. With its comprehensive rewards software and precious blessings, this card gives exquisite value for those in search of to decorate their travel experiences. Cardholders earn up to 2X miles in line with dollar spent on United purchases, eating, and motel stays booked without delay with resorts, and 1X mile on all other purchases. Plus, new cardmembers can earn a widespread welcome bonus after assembly spending requirements. Miles may be redeemed for flights, enhancements, motel stays, vehicle leases, and greater, with no blackout dates or seat restrictions on United-operated flights. Additionally, the cardboard offers precedence boarding, loose checked bags, and two United Club passes in keeping with 12 months, together with no overseas transaction costs. Whether you are a frequent United flyer or revel in the ease of its sizeable network of companions, the United℠ Explorer Card is an invaluable tool for maximizing your travel rewards.

20. Delta SkyMiles® Gold American Express Card

The Delta SkyMiles® Gold American Express Card is a most fulfilling preference for travelers who opt for the convenience and luxury of flying with Delta Air Lines. With its strong rewards program and precious blessings, this card offers fantastic cost for those in search of to elevate their journey reviews.

Cardholders earn as much as 2X miles according to dollar spent on Delta purchases, dining, and groceries, and 1X mile on all different purchases. Plus, new cardmembers can earn a sizeable welcome bonus after meeting spending necessities. Miles can be redeemed for flights, upgrades, lodge stays, automobile leases, and greater, with out a blackout dates or seat restrictions on Delta-operated flights. Additionally, the card offers priority boarding, free checked luggage, and a partner certificates every year upon renewal, along with no foreign transaction expenses. Whether you’re a common Delta flyer or revel in the benefit of its vast network of locations, the Delta SkyMiles® Gold American Express Card is a useful asset for maximizing your tour rewards.

Benefits of Best Travel Rewards Credit Card

The advantages of owning the best travel rewards credit card increase a ways beyond just earning points or miles for journey prices. These playing cards offer a plethora of advantages that cater to common vacationers and people in search of to make the most out of their spending. One of the number one advantages is the ability to earn rewards on normal purchases. With a journey rewards credit card, cardholders can gather factors or miles with each dollar spent, permitting them to earn rewards passively and quick building up their rewards stability.

Moreover, the first-class travel rewards credit playing cards often come with beneficial signal-up bonuses, providing a considerable boost to a cardholder’s rewards balance upon meeting a minimal spending requirement within a specified time body. These signal-up bonuses can translate into extensive savings on travel prices, which include flights, resort remains, or rental motors, making them rather attractive to new cardholders.

Additionally, journey rewards credit playing cards offer a wide range of perks and advantages that enhance the overall tour experience. These perks might also encompass airport living room get admission to, precedence boarding, loose checked luggage, travel coverage coverage, concierge offerings, and declaration credit for tour-related charges. These benefits not most effective provide introduced price and convenience for vacationers but additionally elevate the overall journey enjoy, making it extra fun and pressure-loose.

Furthermore, the fine journey rewards credit cards frequently offer flexibility in how rewards may be redeemed. Cardholders may additionally have the option to switch points or miles to various airline and lodge loyalty programs, maximizing the fee of their rewards. Alternatively, they will select to redeem points or miles directly for travel purchases, presenting simplicity and comfort in redemption options.

In end, the benefits of proudly owning the first-class travel rewards credit card are severa and numerous, ranging from incomes rewards on regular purchases to taking part in one-of-a-kind perks and benefits that decorate the general travel revel in. By leveraging those advantages, cardholders can maximize their rewards income, experience treasured privileges, and make the most out of their tour studies.

Conclusion : Best Travel Rewards Credit Card

In end, the excellent journey rewards credit score card can be a game-changer for common vacationers and those in search of to optimize their spending. These cards provide a bunch of benefits, inclusive of earning rewards on regular purchases, profitable sign-up bonuses, and a wide range of precious perks and benefits that beautify the overall travel experience. With the ability to accumulate factors or miles quick and redeem them for widespread savings on travel fees which include flights, resorts, and rental motors, the exceptional travel rewards credit score cards provide extraordinary value and comfort. Moreover, their flexibility in redemption options and top class privileges together with airport front room get entry to, journey insurance insurance, and concierge offerings cause them to critical partners for vacationers. By deciding on a journey rewards credit score card that aligns with their journey options and spending conduct, cardholders can maximize their rewards profits, experience exceptional privileges, and increase their tour stories to new heights. Ultimately, the exceptional tour rewards credit card is not just a economic device but a gateway to unforgettable adventures and unheard of travel studies.

FAQ’S : Best Travel Rewards Credit Card

What is a journey rewards credit card?

A tour rewards credit card is a form of credit card that gives rewards such as factors or miles for journey-related purchases, which can be redeemed for flights, hotels, condo automobiles, and other tour charges.

How do journey rewards credit score playing cards work?

Travel rewards credit playing cards commonly earn points or miles for every greenback spent on eligible purchases. These rewards can then be redeemed for travel-related prices or different rewards provided by way of the card company.

What are the blessings of a travel rewards credit score card?

The benefits of a journey rewards credit score card may additionally consist of incomes rewards on normal purchases, receiving signal-up bonuses, having access to journey perks consisting of airport lounge access and tour coverage, and enjoying bendy redemption options.

How do I choose the quality tour rewards credit card for me?

When deciding on a journey rewards credit card, keep in mind elements consisting of the incomes fee for rewards, sign-up bonuses, annual fees, redemption options, travel perks, and whether the card aligns along with your travel alternatives and spending habits.

What kinds of rewards can I earn with a journey rewards credit score card?

Travel rewards credit cards generally provide points or miles that may be redeemed for flights, hotel remains, rental automobiles, and other journey-related fees. Some playing cards may offer cash lower back or other rewards.

Do travel rewards credit score cards have annual charges?

Many journey rewards credit cards do have annual prices, however a few playing cards may additionally waive the rate for the first 12 months or provide benefits that offset the price of the charge, inclusive of travel credit or complimentary elite popularity.

Are journey rewards credit score cards worth it?

Whether a journey rewards credit card is really worth it relies upon on your individual spending habits, tour possibilities, and how you intend to apply the card’s rewards and benefits. For common vacationers who can take benefit of the card’s perks, the price can outweigh the yearly rate.

Can I use a journey rewards credit score card for regular purchases?

Yes, tour rewards credit score playing cards can be used for normal purchases, and many playing cards offer bonus rewards for spending in categories along with dining, groceries, and gasoline.