As a frequent flyer, you’ll get to learn more about some of the best travel reward credit cards with the greatest reward offerings, travel bonuses, and travel points that are redeemable for free.

- Key Points & Best Travel Credit Cards for Frequent Flyers

- 10 Best Travel Credit Cards for Frequent Flyers

- 1. American Express Platinum Card

- American Express Platinum Card

- 2. Chase Sapphire Reserve

- 3. Capital One Venture X Rewards

- 4. Citi Premier Card

- 5. United Explorer Card

- 6. Delta SkyMiles Reserve American Express

- 7. Hilton Honors American Express Aspire

- 8. Marriott Bonvoy Boundless Card

- 9. Chase Sapphire Preferred

- 10. Bank of America Travel Rewards Card

- Conclsuion

- FAQ

Each of these cards offer value, cost savings, and a more enjoyable flying experience. Frequent travelers will maximize value for airport lounge access, airline loyalty perks, travel credit reimbursement, and more. You will get a more seamless and enjoyable travel experience.

Key Points & Best Travel Credit Cards for Frequent Flyers

| Travel Credit Card | Key Point |

|---|---|

| American Express Platinum Card | Unlimited airport lounge access + premium travel credits |

| Chase Sapphire Reserve | High points multipliers on travel & dining |

| Capital One Venture X Rewards | Flexible miles transferable to multiple airlines |

| Citi Premier Card | Strong airline transfer partners + bonus categories |

| United Explorer Card | Free checked bags + priority boarding |

| Delta SkyMiles Reserve American Express | Complimentary Delta Sky Club access |

| Hilton Honors American Express Aspire | Luxury hotel perks + airline credits |

| Marriott Bonvoy Boundless Card | Free hotel nights + elite status benefits |

| Chase Sapphire Preferred | Lower annual fee with strong transfer partners |

| Bank of America Travel Rewards Card | No annual fee + simple flat-rate rewards |

10 Best Travel Credit Cards for Frequent Flyers

1. American Express Platinum Card

The American Express Platinum Card is often considered one of the best premium travel credit cards due to its numerous benefits.

This card provides the ability to collect Membership Rewards points which can be redeemed for flights and hotel stays.

There is also an array of credits which can be allocated to travel expenses and hotel stays alongside travel incidentals.

The card also allows travel to dozens of lounges worldwide and its points can be used to buy tickets on many of the leading travel airline programs.

This allows for the card to be an optimal choice for travel award programs and for infrequent to medium travelers, the cost of the card can be justiifed.

American Express Platinum Card

- Premium lounge access – access to Centurion Lounges, to the Priority Pass, along with other partnered lounges in airports across the globe, is offered for a pleasant wait in the airport.

- Generous points earnings – Membership Rewards points has a high earning rate of on for travel and a few other select categories.

- Travel credits – there’s a net.

- Elite perks – boosts hotel benefits with elite status from Hiltons and Marriotts.

- Transfer partners – there is a high level of value to these points that transfer to stores loyalty programs and hotel/airline loyalty programs.

| Pros | Cons |

|---|---|

| Excellent airport lounge access (Centurion, Priority Pass) | Very high annual fee |

| Generous Membership Rewards points | Best value often requires transfer partners |

| Premium travel credits (airlines, hotels, Uber, etc.) | Some credits require enrollment/use to offset fee |

| Strong travel insurance and elite perks | Not ideal for low‑spend travelers |

2. Chase Sapphire Reserve

Travelers have ranked The Chase Sapphire Reserve as their favorite travel credit card due to its amazing benefits and rewards that give you the best travel experience.

Some benefits include an incredible 8 points for travel purchases via Chase and 4 for flights and hotels booked directly.

Dining earns 3x points which adds to money saved, and travel rewards are big with high value points that are transferable to high value airline and hotel partners. One of the most interesting features is the 300 dollar travel credit.

The card also has some of the best amenities such as giving access to over 1,300 airport lounges with its Priority Pass as well as travel protection and reimbursements such as with TSA PreCheck.

Chase Sapphire Reserve

- Elevated travel rewards – bonus points on travel and all other dining, plus even higher value points for redemptions at top tier on Chase Travel.

- Annual travel credit – travel purchases are reimbursed automatically as a perk and assist in offsetting your annual fee.

- Airport lounge access – access is to Priority Pass Select lounges around the globe.

- Travel protections – strong trip cancellation/interruption, and insurance for accidents that travel.

- Transfer partners – these points transfer to large hotel and airline partners at a 1:1 rate.

| Pros | Cons |

|---|---|

| Excellent travel rewards and transfer partners | High annual fee |

| $300 annual travel credit softens cost | Best points value often through travel portal/partners |

| Priority Pass lounge access | Some benefits overlap with other Chase cards |

| Great travel protections | Premium card may be overkill for occasional travelers |

3. Capital One Venture X Rewards

Among the travel credit cards, the Capital One Venture X Rewards card has earned its spot as one of the travel credit cards with the best benefits.

With this card, you get 2 times the miles for every dollar spent and even more if you booked through Capital One travel.

On Capital One Travel, you get 5 times the miles for flights and 10 times the miles for hotel and rental car bookings.

Cardholders are also given a $300 travel credit that can be used annually and a $120 credit for Global Entry/TSA PreCheck.

You also get unlimited access to airport lounges through Capital One and Priority Pass. To top everything off, this card allows you to transfer miles to numerous airline partners.

Capital One Venture X Rewards

- Flat-rate miles – miles are earned at a solid rate on all purchases and even higher on travel booked through Capital One Travel.

- Annual travel credits: Comes with a travel credit of $300 that you can us on bookings made through Capital One.

- Airport lounge access: Free access to Capital One Lounges and Priority Pass.

- Global Entry/TSA PreCheck credit: Speeds up security and customs.

- Transferable miles: Miles can be transferred to airline and hotel partners for award travel.

| Pros | Cons |

|---|---|

| Simple flat‑rate miles on all spending | High annual fee (but credits help) |

| Strong travel credits & lounge access | Some partner transfer rates vary |

| Great for flexible travel bookings | Rewards tilted to travel through Capital One portal |

| Solid entry into premium travel perks | Might duplicate other cards benefits |

4. Citi Premier Card

If you fly frequently, the Citi Premier Card is, on the balance, the best travel credit card, fulfilling the requirements of everyday spending, travel redemptions, and rewards.

You earn 3 ThankYou® Points for every dollar spent on airfare, lodging, restaurants, supermarkets, and gas (with increased rewards for those spent on travel booked through Citi).

Points earned on the card can be transferred to various airline loyalty programs, usually on even 1:1 ratios. There is also an automatic $100 hotel credit each year for Citi travel portal hotel bookings.

There are no foreign transaction fees. With the Premier Card, travel is easier and even less expensive. With an annual fee of $125, the Citi Premier card is worth it.

Citi Premier Card

- Strong travel and everyday rewards: Points are earned for hotel flights, restaurants, supermarkets, and gas and at an elevated rate.

- Flexible points: Thank you Points can be transferred to a number of airline partners.

- Hotel credit: Annual statement credit on qualifying hotel bookings made through Citi’s travel portal.

- No foreign transaction fees: Great for international travel spending.

- Moderate annual fee: Good value for travelers that are frequent and looking for rewards without a super high fee.

| Pros | Cons |

|---|---|

| Strong points on travel, dining, gas | No premium travel credits |

| Transferable to multiple airline partners | Fewer luxury perks than premium cards |

| No foreign transaction fees | Best redemption requires transfers |

| Mid‑range annual fee | Not ideal for lounge access seekers |

5. United Explorer Card

If you frequently travel with United Airlines, the United Explorer Card is a great option. Free checked luggage, priority boarding, free United Club access, and free companion upgrades received at the boarding gate are Premium travel perks this card provides.

Bonus miles are awarded for United purchases, hotel bookings, and dining. Global Entry, hotel stays, and various travel expenses provide statement credits.

Other advantages loyal United travelers will appreciate are the absence of foreign transaction fees and the unique travel protections this card provides.

United Explorer Card

- United airline perks: Free first checked bag and priority boarding on United flights.

- Lounge access: United Club one time passes that are good for two lounges per year.

- Travel credits: Travel costs are reduced with TSA PreCheck/Global Entry credits.

- Bonus miles: Additional miles for purchases on United, hotel stays, and dining.

- No foreign transaction fees: Keeps international travel spending a little more cost effective.

| Pros | Cons |

|---|---|

| Free first checked bag & priority boarding | Rewards skewed to United purchases |

| United lounge passes | Fewer transferable partners |

| TSA PreCheck/Global Entry credit | Benefits best for United loyalists |

| No foreign transaction fees | Limited lounge access overall |

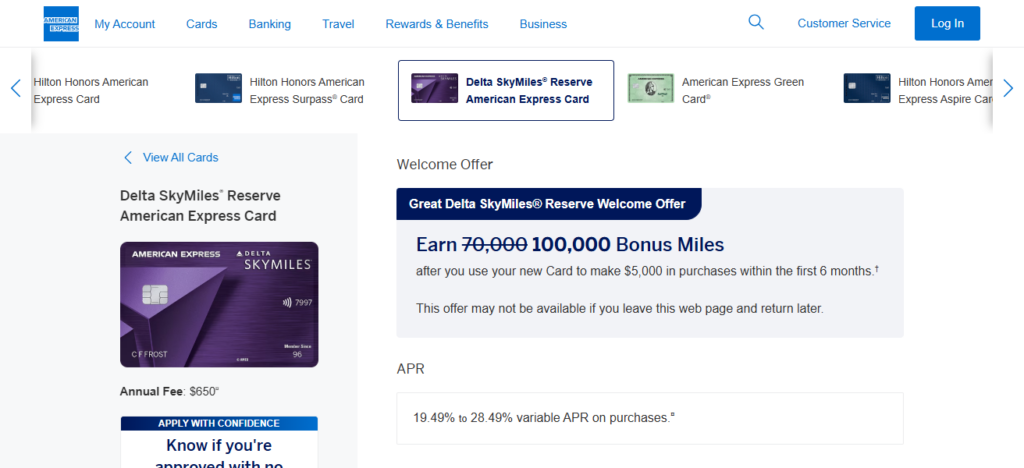

6. Delta SkyMiles Reserve American Express

Among the best travel credit cards, the Delta SkyMiles® Reserve American Express Card is the best card for frequent travelers, especially if they fly Delta.

They will get premium lounge access, which includes access to the Delta Sky Club for up to 15 visits a year and access to the Centurion Lounge when flying Delta (unlimited access is available when spending $75,000) and they will get guest passes.

Holders will earn 3× SkyMiles for all Delta purchases, free first checked baggage, get boarding first, and will get a 15% discount on award Delta flights.

There is also a free Companion Certificate for an extra free round-trip ticket (need to pay the taxes and fees) and reimbursements for TSA PreCheck/Global Entry, a rideshare service, and hotel stays which help with the $650 card fee.

Delta SkyMiles Reserve American Express

- Delta lounge access: Includes Delta Sky Club visits and access to Centurion Lounges when flying Delta.

- Annual companion certificate: Helps bring another person along on award tickets for a lower price.

- Enhanced SkyMiles earnings: Earn bonus miles on Delta purchases.

- Travel perks: Get Delta priority boarding, free checked bags and other benefits.

- Statement credits: Other traveling credits offset the fee for TSA PreCheck, Global Entry.

| Pros | Cons |

|---|---|

| Delta lounge access & elite‑style perks | Very high annual fee |

| Companion certificate annually | Best value only for Delta flyers |

| Enhanced SkyMiles on Delta purchases | Limited outside Delta ecosystem |

| TSA PreCheck/Global Entry credit | Complex benefits structure |

7. Hilton Honors American Express Aspire

The Hilton Honors American Express Aspire Card is a travel rewards card for devoted Hilton loyalty rewards members, flights travelers, and hotel stays.

Card holders will receive 14x points for staying at hilton hotels. He, or she, will earn 7x points for flights purchased directly, for any dining within the Hilton, and he/she will earn 3x points for all other purchases.

This card also comes with a welcome bonus and lots of other perks. Diamond elite status is automatically given to cardholders, bonus nights are rewarded annually, and potential flight and hotel resort credits are given to him/her.

This card also comes with including clear plus servant status, executive status for Emerald Club with national car rentals, and other things make travel far more efficient.

Hilton Honors American Express Aspire

- Automatic elite status: Get Hilton Diamond status for more benefits at hotels.

- Exceptional earn rates: Earn a lot of Hilton points on hotel stays plus a lot for other travel or dining.

- Annual free nights and credits: Also includes free night rewards and travel or flight credits.

- Resort credits: Annual statement credits for resorts up to $400.

- Additional perks: Also includes credits for CLEAR Plus and elite status for a car rental.

| Pros | Cons |

|---|---|

| Automatic Hilton Diamond status | High annual fee |

| Strong Hilton points earnings | Best for Hilton loyalists |

| Lots of travel credits (resort, airline, CLEAR) | Hilton points value can be lower |

| Free night rewards annually | Not ideal if you prefer airline benefits |

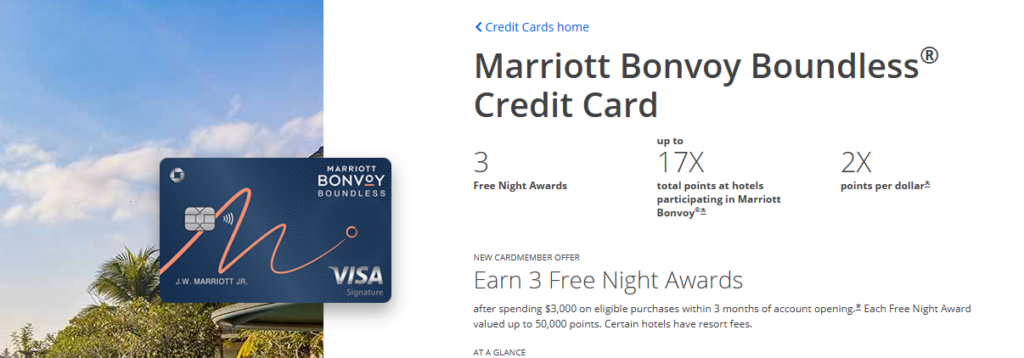

8. Marriott Bonvoy Boundless Card

If people always travel with Marriott, the Marriott Bonvoy Boundless® Card is a good option as a travel credit card.

With the card, you receive 17 Marriott points, as you receive 17 points for every purchase made with Marriott hotels, along with 3 points for each purchase made for gas,

groceries, or at a restaurant, and 2 points for every other purchase you make with the card. You receive a free night every year and after that, you receive silver elite status for bonus points. You can transfer points to 40 airline loyalty programs.

You receive travel protections, and with a low annual fee, it is ideal for people who stay at Marriott hotels often.

Marriott Bonvoy Boundless Card

- Hotel rewards focus: Earn a lot of points on purchases at Marriott plus bonus points in certain categories.

- Annual free night award: One free night each card year is a bonus.

- Elite status: Automatic Silver Elite status and benefits at Marriott.

- Bonus points categories: Dining, gas, and other everyday spending can give extra points.* Simple travel use: You may also transfer the points to airline partners for flight redemptions.

| Pros | Cons |

|---|---|

| Free annual night award | Rewards best for Marriott stays |

| Bonus points on everyday categories | Points transfer value uneven |

| Automatic Silver Elite status | Fewer premium travel perks |

| No foreign transaction fees | Annual fee for a mid‑tier card |

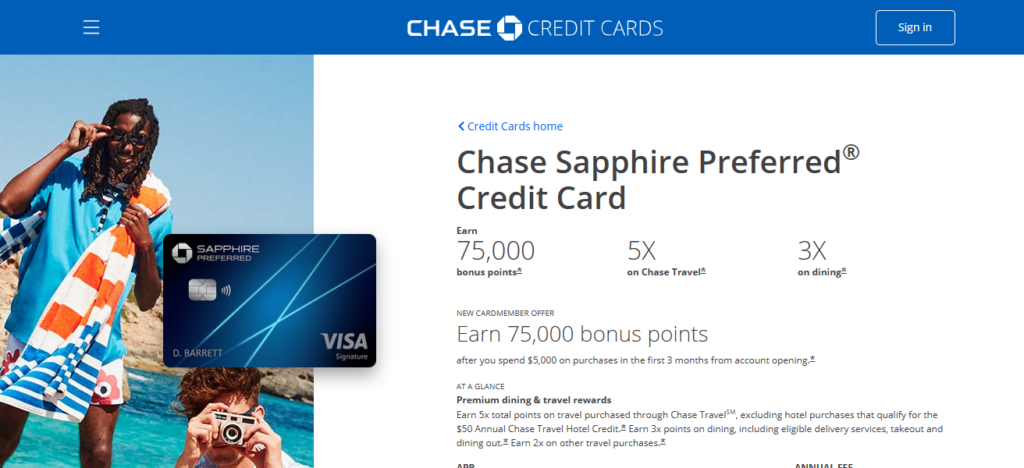

9. Chase Sapphire Preferred

Premium values and variations make the Chase Sapphire Preferred® Card one of the finest travel credit cards for regular flyers.

It earns bonus points for travel and dining along with a generous welcome offer. Cardholders earn ochre points on travel purchased via the Chase portal, and bonus points on everyday dining and travel purchases.

Points for maximum benefit and value can be utilized for flights, hotels, and more and can be transferred 1:1 with numerous top-tier hotels and airline partners.

Cardholders appreciate the travel protections and the absence of foreign transaction fees along with a statement credit for annual hotel bookings. The card has a low annual fee of $95 which makes it ideal for frequent flyers and travelers.

Chase Sapphire Preferred

- Balanced rewards: Earns points at an above-average rate for travel and dining purchases.

- Flexible redemptions: The points can be transferred to airline and hotel partners or redeemed at an agency through Chase Travel.

- Travel and purchase protections: Includes trip cancellation, resale purchase protection, auto rental collision damage waiver, etc.

- Lower annual fee: More accessible than the fees that premium cards charge for travel.

- No foreign transaction fees: Most advantageous for those looking to travel abroad.

| Pros | Cons |

|---|---|

| Great travel & dining rewards | No lounge access |

| Strong transfer partners | Lower travel credit than premium cards |

| Moderate annual fee | Best value with travel portal/travel spend |

| Solid protections | Some perks behind paywalls |

10. Bank of America Travel Rewards Card

The Bank of America® Travel Rewards Card is a good credit cards for frequent flyers who travel often but just want the basics and to spend as little as possible.

Points can be earned on every purchase at a rate of 1.5 points per dollar spent, at Bank of America travel center there is a 3 points per dollar rate as well as a bonus of 250 dollars.

Since there isn’t a fee for foreign transactions, this card is good for use on travel where foreign transactions may be included. Points earned can be used as a credit for statement balances on, plane tickets, hotels, rentals and more.

While this card is not premium and does not have many features, it is a good option for someone who travels a lot consistently.

| Pros | Cons |

|---|---|

| No annual fee | No premium travel perks |

| Simple flat‑rate rewards | No transfer to airline partners |

| No foreign transaction fees | Limited bonus categories |

| Easy redemption toward travel purchases | Not ideal for maximizing reward value |

Conclsuion

To wrap up, the best travel credit cards for frequent flyers are those which gain you bonus points on spend, offer travel perks, and are flexible.

Premium cards like Amex Platinum and Chase Sapphire Reserve are the best for lounge access and elite benefits, while options like Citi Premier and Bank of America Travel Rewards are easy and straightforward.

The right cards to get is based on your travel routine, loyalty to airlines, and your preference for luxury cards with elite benefits, high earning cards with bonuses, or low fee cards.

FAQ

What makes a travel credit card good for frequent flyers?

A great travel card offers high rewards on flights, flexible point transfers to airlines, travel perks (like lounge access), and strong travel protections.

Do travel credit cards charge annual fees?

Many premium cards do, but the benefits and credits often outweigh the cost for frequent travelers.

Can I use points with any airline?

Some cards let you transfer points to multiple airline partners, giving flexibility across carriers.

Are airport lounge passes worth it?

Yes—if you fly often, lounge access enhances comfort and value.

Do all travel cards offer travel insurance?

Most premium cards include trip cancellation/interruption and baggage protections.