This article will cover the Best Travel Credit Cards for International Trips, focusing on cards that help you earn rewards, avoid paying foreign transaction fees, and offer additional travel benefits.

- Key Points & Best Travel Credit Cards for International Trips

- 10 Best Travel Credit Cards for International Trips

- 1. Chase Sapphire Preferred® Card

- 2. Chase Sapphire Reserve®

- 3. Capital One Venture Rewards Credit Card

- 4. American Express® Gold Card

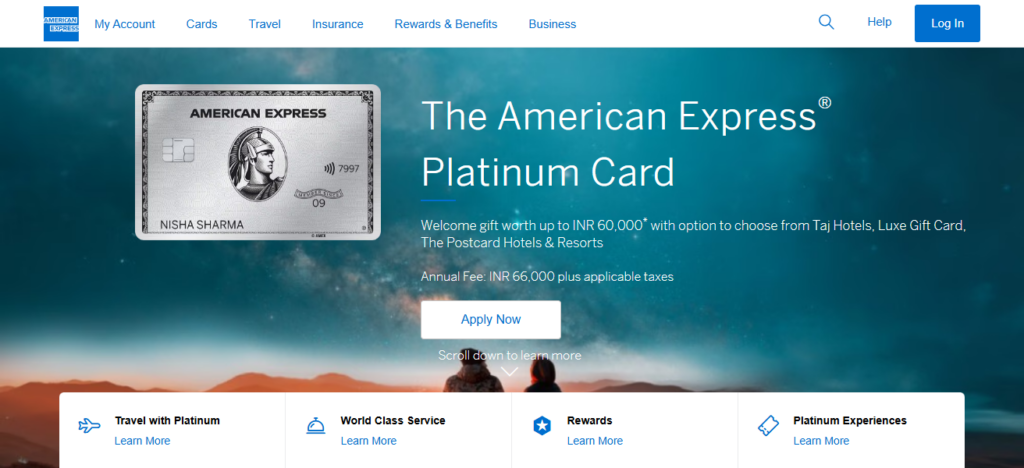

- 5. American Express® Platinum Card

- 6. Citi Premier® Card

- 7. Bank of America® Travel Rewards Credit Card

- 8. Discover it® Miles

- 9. HSBC Premier World Elite Mastercard®

- 10. Barclaycard Arrival Plus® World Elite Mastercard®

- Cocnsluion

- FAQ

Whether you fly often or just a few times a year, these cards can give you travel insurance, lounge access, and flexible redemption, which will make your trips more enjoyable and rewarding.

Key Points & Best Travel Credit Cards for International Trips

| Credit Card | Key Points |

|---|---|

| Chase Sapphire Preferred® Card | No foreign transaction fees, strong travel rewards, flexible point transfers to airlines/hotels. |

| Chase Sapphire Reserve® | Priority Pass lounge access, $300 annual travel credit, high rewards on travel/dining. |

| Capital One Venture Rewards Credit Card | 2x miles on all purchases, no foreign transaction fees, easy redemption for travel expenses. |

| American Express® Gold Card | High rewards on dining worldwide, travel insurance, global acceptance with Amex partners. |

| American Express® Platinum Card | Extensive lounge access (Centurion + Priority Pass), premium travel protections, airline fee credits. |

| Citi Premier® Card | 3x points on air travel, hotels, and dining, points transferable to multiple airline partners. |

| Bank of America® Travel Rewards Credit Card | Unlimited 1.5x points on all purchases, no foreign transaction fees, flexible travel redemptions. |

| Discover it® Miles | No annual fee, 1.5x miles on all purchases, miles matched at end of first year. |

| HSBC Premier World Elite Mastercard® | Global acceptance, travel insurance, lounge access, rewards on international spending. |

| Barclaycard Arrival Plus® World Elite Mastercard® | 2x miles on all purchases, easy redemption for travel, chip-and-PIN for global use. |

10 Best Travel Credit Cards for International Trips

1. Chase Sapphire Preferred® Card

Many international travelers choose the Chase Sapphire Preferred® Card, which is often regarded as one of the best travel credit cards.

Users earn 2x points while traveling and dining, and points can be transferred to important airline and hotel partners.

Since there are no foreign transaction fees, this is good to use while traveling abroad. This card includes international travel and trip cancellation insurance, baggage delay insurance, and purchase protection.

Users can redeem Chase Ultimate Reward points for travel, experiences, and accommodations at a premium value.

Chase Sapphire Preferred also has low annual fees and a good selection of travel perks, providing a well-balanced card for novice travelers.

| Feature | Details |

|---|---|

| Rewards | 2x points on travel and dining |

| Transfer Partners | Points transferable to airlines and hotels |

| Fees | No foreign transaction fees |

| Protections | Trip cancellation, baggage delay, purchase protection |

2. Chase Sapphire Reserve®

The Chase Sapphire Reserve® is ideal for cardholders who frequently travel internationally.

It has a $300 annual travel credit and earns 3x points on travel and dining. Cardholders get travel insurance as well as reimbursement for Global Entry/TSA PreCheck and access to Priority Pass lounges.

You get 3x points which are worth 50% more when redeemed through Chase Ultimate Rewards. It has no foreign transaction which makes it a good card for international use.

It also has luxury benefits and travel assistance. It has a high annual fee, but it is worth it considering the rewards and travel protections for frequent travelers.

| Feature | Details |

|---|---|

| Rewards | 3x points on travel and dining |

| Credits | $300 annual travel credit |

| Lounge Access | Priority Pass membership |

| Protections | Comprehensive travel insurance and emergency assistance |

3. Capital One Venture Rewards Credit Card

The Venture Rewards Credit Card by Capital One is very popular due to how flexible and simple it is to use.

Customers earn twice the miles for every dollar they spend which makes them easy to track, and there are no spending categories to worry about.

Consumers can use card miles to pay for travel expenses, and they can fly with the airline partners.

This credit card does not have fees for foreign transactions, so it is a great card to take for international travel. They offer travel insurance for flight accidents and for lost luggage.

There is also credit for Global Entry and TSA PreCheck. Customers also get Global Entry and TSA PreCheck.

The fees for this card are relatively low, and it is a good option for people who travel often and want uncomplicated rewards.

| Feature | Details |

|---|---|

| Rewards | 2x miles on all purchases |

| Redemption | Miles redeemable for travel or transfer to airlines |

| Fees | No foreign transaction fees |

| Protections | Travel accident insurance and lost luggage reimbursement |

4. American Express® Gold Card

The American Express® Gold Card is great for travelers who like to eat out while traveling. Unlike its competitors, its Gold Card earns 4x points on international Restaurant spend, 4x points on U.S.

Supermarket spend, and 3x points on flight tickets booked directly with airlines. It includes travel insurance to cover lost baggage and rental cars, which is nice since Amex is not always accepted abroad.

It does have partnerships with international vendors. It’s great for people who like to travel and eat out because it does have travel lounge access, points transfers to travel partners, and airline ticket discounts.

It does also put window stickers on the gas stations, which is a bonus since the annual fee can be redeemed with the credits.

| Feature | Details |

|---|---|

| Rewards | 4x points on restaurants, 3x on flights |

| Acceptance | Global merchant partnerships |

| Protections | Baggage insurance and car rental coverage |

| Flexibility | Points transferable to airlines and hotels |

5. American Express® Platinum Card

The American Express Platinum Card is a high-end travel card with a multitude of benefits. If you pay for a flight or hotel in advance, you earn five times the points.

You can get into more than 1,400 airport lounges, even Centurion lounges. You are given free annual credits that can be used for Uber rides, hotel stays, and airline fee reimbursements.

You are given travel protections that cover missing bags, delayed trips, and safety in emergencies out of the county.

You can redeem points at premium airlines and hotels. It has no foreign transaction fees, making it perfect for people who like international travel.

The annual fee may be high, but the benefits are unparalleled for those that travel a lot.

| Feature | Details |

|---|---|

| Rewards | 5x points on flights and prepaid hotels |

| Lounge Access | Centurion + Priority Pass lounges |

| Credits | Airline fee, Uber, and hotel credits |

| Protections | Trip delay, baggage coverage, emergency assistance |

6. Citi Premier® Card

The Citi Premier® Card is an excellent all-around travel card as it earns an impressive 3x points on air travel, hotels, dining, and supermarkets.

Additionally, cardholders can transfer their points to various airline partners, useful for international travel.

On top of that, the card does not charge foreign transaction fees, and it offers trip-cancellation coverage and car rental insurance.

Travel protections are nice to have, especially considering the card’s reasonable annual fee. Cardholders can redeem their points for flights, hotels, and experiences through Citi’s travel portal.

Overall, the Citi Premier® Card is an excellent card for international travelers looking for flexible point transfer options.

| Feature | Details |

|---|---|

| Rewards | 3x points on air travel, hotels, dining |

| Transfer Partners | Multiple airline partners |

| Fees | No foreign transaction fees |

| Protections | Trip cancellation and car rental insurance |

7. Bank of America® Travel Rewards Credit Card

The Bank of America® Travel Rewards Credit Card has no annual fee and is great for international travel since you’ll earn unlimited points on all purchases.

Points can be redeemed for any travel expenses, and deposits, and there are no foreign transaction fees. Travel insurance and monitoring for fraud are included.

The card has no foreign transaction fees. Budget travelers will appreciate the no-frills travel perks and the simplicity of earning points.

There are no blackout dates for flights, hotels, and even for dining. The card’s ideal customer is someone who values building points but doesn’t want to pay an annual fee.

| Feature | Details |

|---|---|

| Rewards | 1.5x points on all purchases |

| Fees | No annual fee, no foreign transaction fees |

| Redemption | Points redeemable for flights, hotels, dining |

| Protections | Emergency assistance and fraud monitoring |

8. Discover it® Miles

Discover it® Miles card is excellent for overseas travel, because it has no foreign transactions fees, protective travel fraud monitoring and purchase protection, and it helps you travel to earn 1.5x miles.

Miles are redeemable for cash back, or can be used to travel. However, 5Discover card is less accepted than Visa or Mastercard. Discover is partnered with many international networks, though, so the card is still usable.

Matches all miles earned the first year, so you get double rewards. The first year is therefore beneficial, and with no annual fees it’s perfect for new travelers looking for value cards.

| Feature | Details |

|---|---|

| Rewards | 1.5x miles on all purchases |

| Bonus | First-year miles match (double rewards) |

| Fees | No foreign transaction fees |

| Protections | Fraud monitoring and purchase protection |

9. HSBC Premier World Elite Mastercard®

The HSBC Premier World Elite Mastercard® partners with customers of HSBC for Mastercard global travelers.

The card covers international spending, inclusive travel insurance, and free lounge access. The card’s overseas transaction fees are waived.

The card features concierge services, discounts on hotels, and card replacement services during emergencies while traveling.

Points on the card are redeemable for hotels, flights, and experiences. The card is especially good will customers of HSBC that travel regularly.

The card is a good choice for international professionals and frequent travelers because of the premium benefits and unlimited global usage.

| Feature | Details |

|---|---|

| Rewards | Points on international spending |

| Lounge Access | Complimentary global lounge access |

| Protections | Travel insurance and emergency card replacement |

| Benefits | Concierge services and hotel discounts |

10. Barclaycard Arrival Plus® World Elite Mastercard®

The Barclaycard Arrival Plus® World Elite Mastercard® has a simple earning structure where you earn a flat 2x miles on every dollar you spend.

You can redeem those miles for almost any travel-related purchase using the statement credit feature, and you don’t need to worry about foreign transaction fees.

This card does have an annual fee, but it comes with a decent amount of travel protections such as trip cancellation and rental car insurance.

The card does have chip-and-PIN technology, which is great for Europe, and it offers a good combination of straightforwardness and practicality for frequent travelers

| Feature | Details |

|---|---|

| Rewards | 2x miles on all purchases |

| Redemption | Simple statement credit for travel expenses |

| Technology | Chip-and-PIN for global usability |

| Protections | Trip cancellation and car rental coverage |

Cocnsluion

In cocnsluion Selecting top travel credit cards for international travel can guarantee less hassles, more savings, and additional perks.

Points and miles, complimentary access to airport lounges, travel protections, no transaction fees, and insured trip cancellation all optimize overseas travels.

Different cards fit different types of frequent fliers based on their way of life, budget, and how often they travel.

FAQ

What makes a credit card good for international travel?

Low or no foreign transaction fees, global acceptance, travel rewards, and insurance protections.

Do travel credit cards charge foreign transaction fees?

The best ones waive these fees, saving you 2–3% on every international purchase.

Which cards offer airport lounge access?

Premium cards like Chase Sapphire Reserve® and Amex Platinum provide global lounge access.