Best Trip Cancellation Insurance : Selecting the excellent ride cancellation coverage calls for cautious consideration of different factors to ensure complete insurance and peace of thoughts. Firstly, it’s vital to assess the scope of coverage offered through one-of-a-kind plans. Look for guidelines that provide safety for a wide variety of scenarios, such as experience cancellations because of contamination, harm, or unexpected emergencies. Additionally, insurance for journey interruptions, delays, and luggage loss or put off can be vital in safeguarding your investment.

- Defination Of Best Trip Cancellation Insurance

- Importance of Best Trip Cancellation Insurance

- Here Is The List Of 20 Best Trip Cancellation Insurance In 2024

- 20 Best Trip Cancellation Insurance In 2024

- 1. Allianz Global Assistance (Best Trip Cancellation Insurance)

- 2. TravelGuard

- 3. World Nomads

- 4. Travelex Insurance Services (Best Trip Cancellation Insurance)

- 5. AXA Assistance USA

- 6. CSA Travel Protection

- 7. Travel Insured International

- 8. Generali Global Assistance (Best Trip Cancellation Insurance)

- 9. Seven Corners

- 10. Berkshire Hathaway Travel Protection

- 11. IMG

- 12. Trawick International (Best Trip Cancellation Insurance)

- 13. RoamRight

- 15. John Hancock Insurance Agency

- 16. April Travel Protection (Best Trip Cancellation Insurance)

- 17. Nationwide Mutual Insurance Company

- 18. GeoBlue

- 19. American Express Travel Insurance

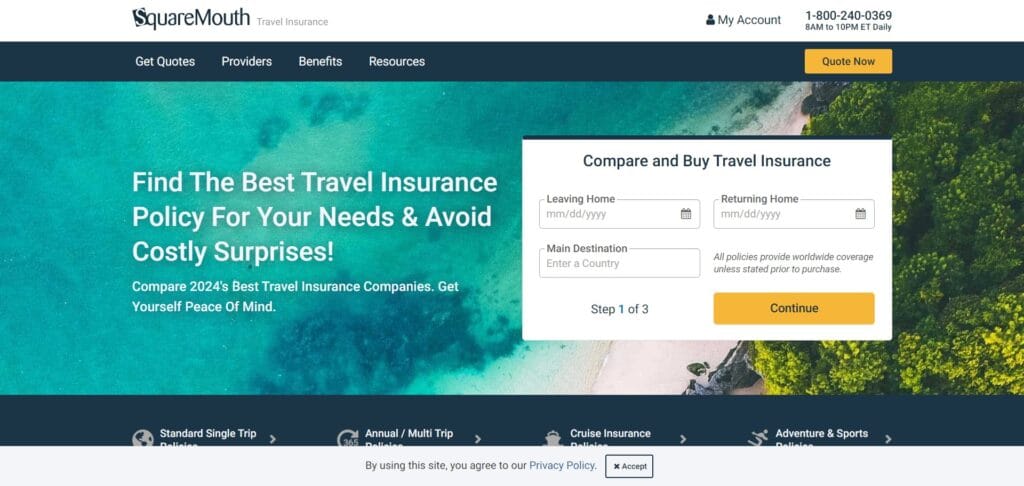

- 20. Squaremouth (Best Trip Cancellation Insurance)

- Benefits of Best Trip Cancellation Insurance

- Conclusion : Best Trip Cancellation Insurance

- FAQ’S : Best Trip Cancellation Insurance

- What is trip cancellation insurance, and why do I need it?

- What does experience cancellation insurance commonly cowl?

- What are covered reasons for ride cancellation?

- Can I cancel my journey for any cause with ride cancellation coverage?

- How do I report a claim for journey cancellation coverage?

- Is journey cancellation coverage similar to journey insurance?

- How tons does journey cancellation insurance price?

- Does journey cancellation insurance cover pre-present clinical conditions?

Another critical issue to assess is the compensation coverage. Opt for coverage plans that offer complete or partial refunds for ride cancellations, being attentive to any deductibles or boundaries. Flexible reimbursement options can offer monetary comfort in case of unexpected occasions forcing you to cancel or shorten your trip.

Furthermore, don’t forget the quantity of clinical coverage provided with the aid of the insurance plan, especially if you’re traveling overseas where healthcare expenses can be exorbitant. Adequate scientific insurance guarantees you acquire proper treatment without incurring widespread charges out of pocket.

Moreover, examine the recognition and reliability of the coverage provider. Research client evaluations, ratings, and any past claim reports to gauge the corporation’s responsiveness and efficiency in handling claims.

Lastly, aspect inside the value of the insurance rates in comparison to the overall value of your experience. While it’s tempting to choose the most inexpensive choice, prioritize complete coverage that aligns along with your journey wishes and capability risks.

By thoroughly assessing those factors and selecting a good coverage issuer, you can make certain you are safely covered in opposition to unforeseen circumstances which can disrupt your travel plans. Remember, making an investment in fine ride cancellation insurance offers useful peace of thoughts, permitting you to experience your travels worry-unfastened.

Defination Of Best Trip Cancellation Insurance

The definition of the “high-quality” trip cancellation coverage hinges on various factors that cater to person desires and preferences. At its core, the exceptional experience cancellation insurance gives complete coverage and economic protection towards unexpected occasions which can disrupt travel plans. This form of insurance commonly reimburses non-refundable experience fees if the ride is canceled or interrupted because of included reasons.

Key features of the satisfactory journey cancellation coverage frequently encompass coverage for ride cancellations or interruptions caused by sudden contamination, damage, or demise of the vacationer, instant circle of relatives participants, or journey companions. Additionally, insurance may additionally amplify to sudden occasions inclusive of natural failures, extreme weather situations, terrorist incidents, or airline strikes that render the journey unfeasible or unsafe.

Moreover, the best experience cancellation coverage guidelines regularly provide coverage for a huge range of pre-paid trip costs, including airfare, accommodation, transportation, and excursion applications. This ensures that vacationers can recoup their economic losses in the event of a ride cancellation or interruption.

Furthermore, flexibility in compensation alternatives and the volume of clinical insurance are critical elements of the fine trip cancellation coverage. Flexible compensation regulations allow vacationers to get hold of full or partial refunds for canceled trips, while comprehensive clinical insurance guarantees access to necessary healthcare offerings overseas with out incurring exorbitant costs.

Ultimately, what constitutes the satisfactory ride cancellation coverage may additionally range relying on person choices, journey plans, and finances constraints. However, via prioritizing comprehensive insurance, dependable repayment regulations, and respectable insurance vendors, vacationers can mitigate dangers and experience peace of mind at some point of their journeys.

Importance of Best Trip Cancellation Insurance

The significance of getting the satisfactory journey cancellation insurance can not be overstated, as it serves as a crucial protection net for tourists dealing with unforeseen disruptions. Travel plans are often made well earlier, and situations beyond our manage can rise up, main to ride cancellations or interruptions. In such scenarios, having comprehensive coverage coverage can offer monetary safety and peace of mind.

One of the number one blessings of journey cancellation insurance is its potential to reimburse non-refundable fees incurred earlier than the trip. This consists of fees associated with flights, accommodations, excursions, and different pre-paid arrangements. Without coverage, vacationers risk losing extensive quantities of money within the event of cancellations due to infection, emergencies, or surprising occasions like herbal disasters or political unrest.

Moreover, the great journey cancellation insurance gives coverage for a huge range of conditions which can necessitate canceling or interrupting journey plans. Whether it’s a unexpected contamination, damage, or demise in the own family, or unexpected events like process loss or jury obligation, having insurance ensures that tourists aren’t financially stressed by circumstances past their manage.

Beyond economic compensation, experience cancellation insurance offers helpful assistance and help all through worrying conditions. Reputable insurance providers provide 24/7 assistance services, which include get right of entry to to emergency scientific referrals, tour help, and coordination of travel preparations in case of emergencies. This level of aid may be essential, in particular whilst visiting to strange locations or going through language barriers.

In essence, investing inside the fine experience cancellation coverage is a prudent decision for any vacationer. It offers financial safety, peace of mind, and valuable help during surprising emergencies, permitting travelers to navigate disruptions with self belief and recognition on enjoying their journeys.

Here Is The List Of 20 Best Trip Cancellation Insurance In 2024

- Allianz Global Assistance (Best Trip Cancellation Insurance)

- TravelGuard

- World Nomads

- Travelex Insurance Services (Best Trip Cancellation Insurance)

- AXA Assistance USA

- CSA Travel Protection

- Travel Insured International

- Generali Global Assistance (Best Trip Cancellation Insurance)

- Seven Corners

- Berkshire Hathaway Travel Protection

- IMG

- Trawick International (Best Trip Cancellation Insurance)

- RoamRight

- AIG Travel Guard

- John Hancock Insurance Agency

- April Travel Protection (Best Trip Cancellation Insurance)

- Nationwide Mutual Insurance Company

- GeoBlue

- American Express Travel Insurance

- Squaremouth (Best Trip Cancellation Insurance)

20 Best Trip Cancellation Insurance In 2024

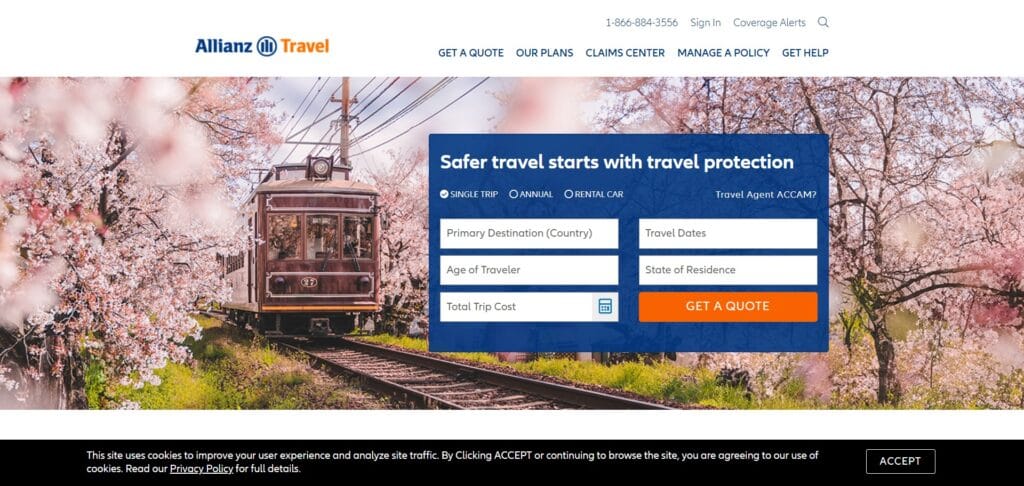

1. Allianz Global Assistance (Best Trip Cancellation Insurance)

Allianz Global Assistance gives comprehensive journey cancellation insurance to offer tourists with peace of mind and economic protection against unexpected occasions which can disrupt their tour plans. Their rules usually cowl trip cancellation, journey interruption, journey put off, and different related charges together with emergency medical costs, luggage loss, or apartment vehicle damage.

With Allianz Global Assistance, tourists can personalize their coverage based on their needs and choices, ensuring they acquire ok protection for their ride investment. Additionally, Allianz’s 24/7 customer service and claims help ensure travelers receive set off support and repayment in the event of a covered claim, making it a trusted choice for tourists worldwide.

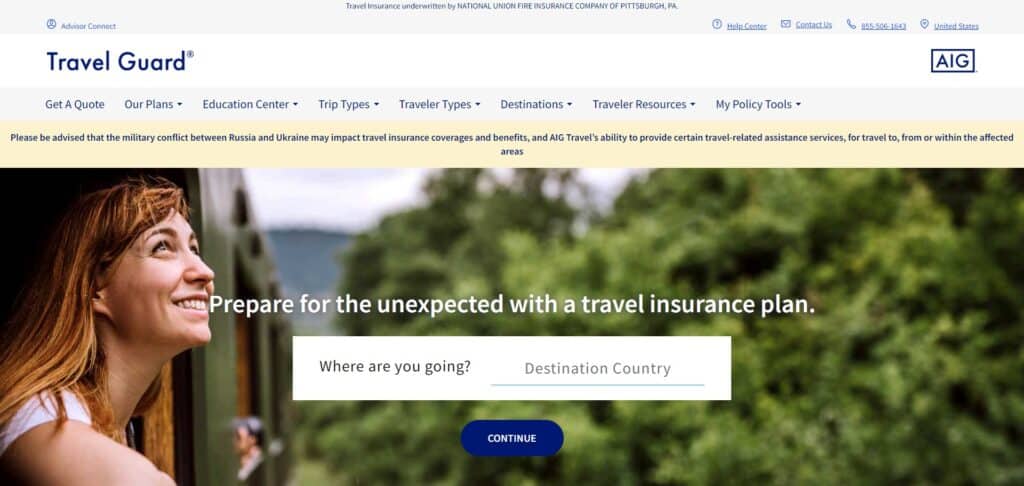

2. TravelGuard

TravelGuard offers comprehensive journey cancellation insurance designed to guard travelers towards surprising activities that can force them to cancel or interrupt their trips. Their policies usually consist of insurance for experience cancellation, journey interruption, trip postpone, emergency scientific costs, bags loss, and different associated costs.

With TravelGuard, travelers can select from a number coverage options and add-ons to tailor their policy to suit their unique needs and alternatives. Additionally, TravelGuard’s spherical-the-clock help services ensure tourists get hold of spark off assist and help within the event of an emergency or protected claim, presenting peace of mind at some stage in their adventure.

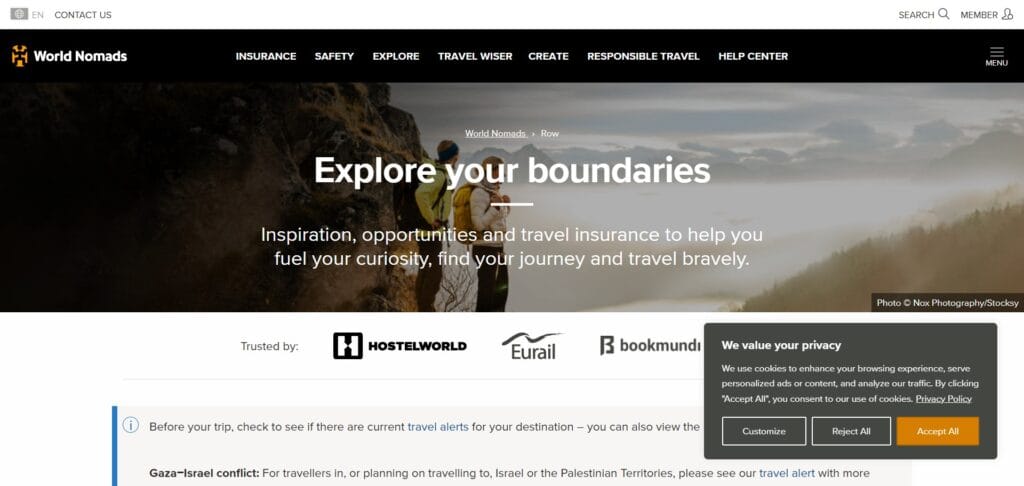

3. World Nomads

World Nomads makes a speciality of imparting tour coverage designed for adventurous travelers who interact in sports which includes hiking, skiing, diving, and extra. Their trip cancellation coverage guidelines provide coverage for experience cancellation, ride interruption, emergency medical expenses, evacuation, and other associated costs unique to journey travel.

With World Nomads, travelers can experience the flexibility to increase their coverage or make changes to their policy at the same time as at the go. Additionally, World Nomads’ dedicated customer service group is available 24/7 to assist tourists with any inquiries or emergencies, making sure they receive the support they need, no matter in which they are inside the world.

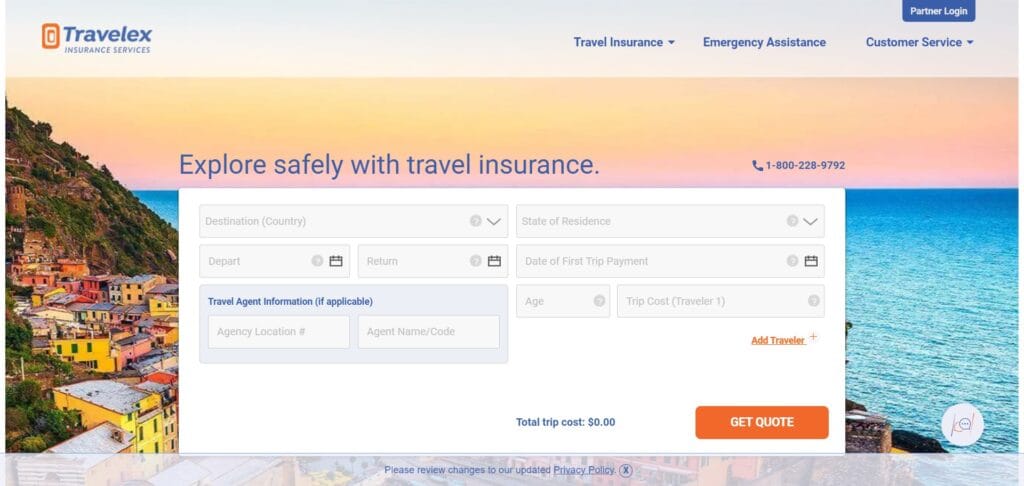

4. Travelex Insurance Services (Best Trip Cancellation Insurance)

Travelex Insurance Services offers comprehensive experience cancellation insurance designed to guard tourists towards unexpected events which could disrupt their tour plans. Their rules usually include insurance for trip cancellation, trip interruption, trip put off, emergency scientific charges, luggage loss, and other associated expenses.

With Travelex Insurance Services, vacationers can pick out from a variety of insurance alternatives and add-ons to customise their coverage to healthy their individual needs and preferences. Additionally, Travelex’s devoted claims assistance team guarantees vacationers acquire prompt guide and repayment within the event of a covered claim, imparting peace of mind in the course of their journey.

5. AXA Assistance USA

AXA Assistance USA offers ride cancellation coverage designed to provide tourists with monetary protection towards unforeseen occasions that may force them to cancel or interrupt their trips. Their rules usually consist of coverage for trip cancellation, ride interruption, ride delay, emergency medical expenses, evacuation, and other related charges.

With AXA Assistance USA, vacationers can experience the ability to customise their coverage primarily based on their desires and options. Additionally, AXA’s 24/7 customer support and claims assistance make certain tourists acquire activate help and compensation in the occasion of a blanketed claim, making it a depended on desire for travelers seeking peace of thoughts while travelling.

6. CSA Travel Protection

CSA Travel Protection focuses on presenting comprehensive experience cancellation insurance designed to shield tourists in opposition to unforeseen activities which could disrupt their journey plans. Their regulations typically consist of insurance for experience cancellation, trip interruption, experience delay, emergency medical charges, evacuation, and other associated charges.

With CSA Travel Protection, travelers can choose from various insurance options and accessories to personalize their policy to in shape their particular wishes and preferences. Additionally, CSA’s spherical-the-clock help offerings make sure vacationers acquire set off guide and reimbursement in the event of a included claim, offering peace of thoughts during their journey.

7. Travel Insured International

Travel Insured International gives comprehensive experience cancellation insurance designed to offer vacationers with economic safety in opposition to unexpected activities which could pressure them to cancel or interrupt their trips. Their rules typically include coverage for journey cancellation, trip interruption, journey put off, emergency scientific expenses, evacuation, and other associated costs.

With Travel Insured International, travelers can personalize their coverage based totally on their wishes and options, ensuring they obtain ok safety for his or her experience funding. Additionally, Travel Insured International’s devoted customer service crew is available 24/7 to help travelers with any inquiries or emergencies, supplying peace of mind all through their journey.

8. Generali Global Assistance (Best Trip Cancellation Insurance)

Generali Global Assistance gives comprehensive trip cancellation insurance plans designed to guard vacationers against unexpected activities which could disrupt their travel plans. Their regulations normally cowl experience cancellations, interruptions, delays, and other unexpected occasions including clinical emergencies or natural screw ups.

With customizable insurance alternatives, travelers can select the extent of protection that fine fits their needs and budget. Generali Global Assistance’s 24/7 customer service ensures tourists acquire help and steerage every time they stumble upon issues for the duration of their journey. Whether it is reimbursing non-refundable journey charges or presenting emergency scientific assistance, Generali Global Assistance strives to provide peace of mind to vacationers, allowing them to revel in their trips with self belief.

9. Seven Corners

Seven Corners offers complete journey cancellation insurance plans tailor-made to satisfy the numerous desires of tourists. Their guidelines provide coverage for journey cancellations, interruptions, delays, and other unexpected activities consisting of scientific emergencies or natural failures. With flexible options and customizable coverage limits, travelers can choose the plan that pleasant aligns with their journey alternatives and price range.

Seven Corners’ responsive customer service group is to be had 24/7 to assist tourists with claims processing, emergency assistance, and different inquiries. Whether travelers are making plans a leisurely holiday or a commercial enterprise trip, Seven Corners strives to offer dependable coverage and assist, ensuring a worry-unfastened travel experience for all.

10. Berkshire Hathaway Travel Protection

Berkshire Hathaway Travel Protection offers complete experience cancellation insurance plans designed to shield tourists towards unexpected activities that could disrupt their tour plans. Their guidelines usually cowl trip cancellations, interruptions, delays, and different sudden situations such as medical emergencies or natural screw ups.

With flexible coverage options and customizable functions, tourists can tailor their coverage plans to satisfy their particular wishes and preferences. Berkshire Hathaway Travel Protection’s dedicated claims group presents activate assistance and support to vacationers, ensuring efficient claims processing and backbone. Whether travelers are embarking on a brief getaway or an extended vacation, Berkshire Hathaway Travel Protection strives to supply dependable coverage and peace of thoughts throughout their journeys.

11. IMG

IMG offers a range of comprehensive ride cancellation coverage plans designed to shield travelers in opposition to surprising occasions that could effect their journey plans. Their regulations generally cowl journey cancellations, interruptions, delays, and other unexpected situations including scientific emergencies or natural failures.

With customizable coverage options and flexible capabilities, tourists can choose the plan that fine suits their needs and budget. IMG’s skilled customer support team is to be had around the clock to help vacationers with claims processing, emergency assistance, and other inquiries. Whether vacationers are making plans a domestic getaway or an worldwide journey, IMG strives to provide reliable coverage and guide, making sure a worry-unfastened travel experience for all.

12. Trawick International (Best Trip Cancellation Insurance)

Trawick International offers comprehensive ride cancellation insurance plans designed to shield tourists against sudden activities which can disrupt their travel plans. Their rules typically cover experience cancellations, interruptions, delays, and different unforeseen occasions including medical emergencies or herbal screw ups.

With customizable coverage alternatives and bendy functions, vacationers can tailor their insurance plans to meet their precise wishes and preferences. Trawick International’s dedicated claims crew presents activate help and assist to travelers, ensuring green claims processing and determination. Whether travelers are embarking on a leisurely vacation or a business ride, Trawick International strives to supply reliable insurance and peace of mind in the course of their trips.

13. RoamRight

RoamRight offers comprehensive journey cancellation insurance plans designed to offer travelers with peace of thoughts and financial safety towards sudden events that could impact their tour plans. Their rules typically cowl journey cancellations, interruptions, delays, and other unexpected occasions which include scientific emergencies or herbal failures.

With customizable insurance alternatives and flexible features, vacationers can select the plan that nice fits their needs and choices. RoamRight’s experienced claims crew is to be had 24/7 to assist travelers with claims processing, emergency help, and different inquiries. Whether vacationers are exploring new destinations or revisiting favourite spots, RoamRight strives to deliver dependable coverage and support, ensuring a fear-free journey enjoy for all.

15. John Hancock Insurance Agency

John Hancock Insurance Agency gives a variety of complete trip cancellation insurance plans designed to defend travelers against unexpected activities that can disrupt their travel plans. Their regulations normally cowl trip cancellations, interruptions, delays, and other unexpected circumstances which include medical emergencies or herbal disasters.

With customizable coverage options and flexible capabilities, vacationers can select the plan that first-class fits their needs and choices. John Hancock Insurance Agency’s dedicated customer support group gives activate help and assist to vacationers, making sure green claims processing and resolution. Whether travelers are embarking on a quick getaway or an extended holiday, John Hancock Insurance Agency strives to deliver reliable insurance and peace of mind throughout their trips.

16. April Travel Protection (Best Trip Cancellation Insurance)

April Travel Protection gives comprehensive journey cancellation coverage plans designed to offer tourists with monetary protection and peace of thoughts in opposition to surprising events that can impact their travel plans. Their rules usually cover ride cancellations, interruptions, delays, and different unexpected circumstances consisting of medical emergencies or natural screw ups.

With customizable insurance options and bendy features, travelers can tailor their insurance plans to satisfy their specific wishes and alternatives. April Travel Protection’s skilled claims crew is available 24/7 to help tourists with claims processing, emergency assistance, and other inquiries. Whether vacationers are exploring new locations or revisiting favourite spots, April Travel Protection strives to deliver dependable coverage and help, ensuring a worry-free journey experience for all.

17. Nationwide Mutual Insurance Company

Nationwide Mutual Insurance Company offers complete experience cancellation insurance plans designed to defend vacationers towards unexpected events that can disrupt their journey plans. Their policies generally cowl experience cancellations, interruptions, delays, and different surprising situations inclusive of medical emergencies or herbal disasters. With customizable insurance alternatives and flexible capabilities, tourists can choose the plan that satisfactory suits their desires and price range. Nationwide Mutual Insurance Company’s responsive customer service crew offers assistance and support to tourists at some point of their journeys, making sure peace of thoughts and financial protection. Whether vacationers are embarking on a domestic experience or an international journey, Nationwide Mutual Insurance Company strives to supply dependable coverage and superb provider.

18. GeoBlue

GeoBlue gives complete experience cancellation insurance plans designed to offer travelers with peace of mind and financial protection against surprising occasions which can impact their tour plans. Their regulations typically cowl trip cancellations, interruptions, delays, and other unforeseen situations including clinical emergencies or natural disasters. With customizable coverage options and flexible functions, tourists can tailor their insurance plans to meet their unique wishes and alternatives.

GeoBlue’s great community of healthcare companies and skilled claims crew make certain vacationers obtain activate help and help, whether or not they’re looking for clinical treatment overseas or filing a claim for experience cancellation. Whether vacationers are on a brief-term excursion or an prolonged worldwide assignment, GeoBlue strives to supply dependable insurance and super provider.

19. American Express Travel Insurance

designed to shield vacationers towards unforeseen activities which can disrupt their tour plans. Their guidelines generally cowl trip cancellations, interruptions, delays, and other sudden occasions which includes medical emergencies or natural failures. With customizable insurance options and bendy functions, vacationers can select the plan that nice fits their desires and choices. American Express Travel Insurance’s committed customer service team affords help and guide to vacationers for the duration of their trips, making sure peace of mind and economic safety. Whether tourists are embarking on a leisurely excursion or a commercial enterprise trip, American Express Travel Insurance strives to deliver dependable coverage and excellent provider.

20. Squaremouth (Best Trip Cancellation Insurance)

Squaremouth gives comprehensive trip cancellation coverage plans designed to provide travelers with peace of mind and financial protection in opposition to sudden occasions which could effect their tour plans. Their guidelines normally cowl trip cancellations, interruptions, delays, and different unforeseen occasions such as medical emergencies or herbal screw ups.

With customizable coverage alternatives and flexible capabilities, travelers can tailor their coverage plans to fulfill their specific needs and choices. Squaremouth’s consumer-friendly website and knowledgeable customer support crew make it easy for tourists to compare plans, obtain costs, and purchase coverage on line. Whether vacationers are making plans a short getaway or a protracted-term trip, Squaremouth strives to deliver reliable coverage and excellent provider, ensuring a fear-free journey enjoy for all.

Benefits of Best Trip Cancellation Insurance

The advantages of obtaining the best ride cancellation insurance increase a long way beyond mere financial safety. Firstly, such insurance presents vacationers with peace of mind, knowing that they’re safeguarded against unexpected occasions that might probably derail their plans. Whether it is a sudden illness, a family emergency, or surprising work commitments, ride cancellation insurance ensures that tourists can recoup their non-refundable prices and mitigate the monetary impact of canceling or interrupting their journey.

Additionally, trip cancellation coverage offers flexibility and reassurance in planning travel itineraries. By knowing that they may be blanketed in case of emergencies, tourists can with a bit of luck e-book flights, inns, and different prepaid fees nicely in advance, with out the fear of dropping their funding if their plans exchange abruptly. This flexibility allows travelers to take gain of early booking discounts and steady applicable motels and flights with out traumatic about the economic repercussions of unforeseen cancellations.

Moreover, the fine trip cancellation coverage often includes insurance for a wide range of conditions, such as trip delays, neglected connections, and misplaced or behind schedule luggage. This complete coverage ensures that travelers are covered towards diverse travel-associated mishaps that could disrupt their journey. In the occasion of such occurrences, coverage can provide repayment for added fees incurred, along with accommodation and meals all through delays, or replacement of crucial objects in case of lost luggage.

Furthermore, journey cancellation insurance offers priceless assistance and help services to tourists facing emergencies at the same time as abroad. Reputable coverage vendors offer round-the-clock emergency assistance hotlines staffed with multilingual professionals who can offer scientific referrals, arrange emergency transportation, and provide guidance in navigating unusual healthcare structures. This stage of support can be specially reassuring while visiting to faraway destinations or nations where get admission to to best medical care may be limited.

In end, the advantages of the quality experience cancellation coverage enlarge past economic protection to encompass peace of mind, flexibility in tour making plans, comprehensive insurance for numerous contingencies, and helpful assistance services. By making an investment in ride cancellation coverage, tourists can embark on their trips with confidence, understanding that they’re organized for the surprising and can attention on taking part in their tour reports to the fullest.

Conclusion : Best Trip Cancellation Insurance

In conclusion, the importance of securing the first-class experience cancellation insurance cannot be overstated. This type of coverage provides travelers with beneficial peace of thoughts, knowing that they’re covered in opposition to unforeseen occasions that could disrupt their travel plans. By imparting economic reimbursement for non-refundable expenses incurred earlier than the trip, together with flights, resorts, and excursions, ride cancellation coverage ensures that tourists can navigate sudden cancellations or interruptions without facing massive monetary losses.

Moreover, the nice journey cancellation coverage gives flexibility in travel planning, allowing tourists to with a bit of luck book preparations earlier without worry of dropping their funding in case of emergencies. Comprehensive insurance extends beyond experience cancellations to include protection in opposition to a huge range of eventualities, inclusive of trip delays, neglected connections, and lost or delayed baggage, similarly enhancing vacationers’ self belief in their coverage coverage.

Additionally, trip cancellation coverage offers essential help and support services, together with 24/7 emergency hotlines staffed by using professionals who can offer clinical referrals, arrange emergency transportation, and offer steering in navigating surprising environments. This degree of assist may be specially treasured whilst journeying to far flung locations or international locations with limited access to fine healthcare.

In essence, making an investment within the best trip cancellation coverage is a wise decision for any traveler. It gives comprehensive coverage, economic protection, and beneficial help offerings, permitting vacationers to embark on their journeys with self assurance and peace of mind. By prioritizing the security and flexibility furnished via trip cancellation coverage, travelers can cognizance on enjoying their journey experiences to the fullest, understanding that they’re organized for the unexpected.

FAQ’S : Best Trip Cancellation Insurance

What is trip cancellation insurance, and why do I need it?

Trip cancellation insurance is a type of journey coverage that reimburses you for non-refundable journey expenses if you have to cancel your trip because of included motives including illness, damage, or unforeseen emergencies. It presents monetary safety and peace of thoughts to your travel funding.

What does experience cancellation insurance commonly cowl?

Trip cancellation insurance typically covers non-refundable expenses like airfare, resorts, and tour packages if you have to cancel your trip for covered motives. It can also offer coverage for ride interruptions, delays, and bags loss or delay.

What are covered reasons for ride cancellation?

Covered reasons for trip cancellation typically encompass contamination, damage, or dying of the tourist, a family member, or a journeying partner. Other protected reasons may additionally encompass natural failures, extreme weather, terrorist incidents, or airline moves.

Can I cancel my journey for any cause with ride cancellation coverage?

Some trip cancellation coverage regulations offer “cancel for any motive” (CFAR) coverage, which lets in you to cancel your journey for any purpose not explicitly excluded via the coverage. However, CFAR insurance is normally non-obligatory and can include additional expenses.

How do I report a claim for journey cancellation coverage?

To record a declare for trip cancellation insurance, you normally want to touch your insurance provider as quickly as feasible and offer documentation helping your claim, which includes scientific statistics, receipts for non-refundable expenses, and some other applicable data.

Is journey cancellation coverage similar to journey insurance?

Trip cancellation insurance is a type of travel coverage, but it particularly specializes in reimbursing non-refundable experience fees when you have to cancel your trip for protected reasons. Travel coverage may provide additional coverage along with medical charges, emergency medical evacuation, and baggage insurance.

How tons does journey cancellation insurance price?

The value of experience cancellation coverage varies relying on elements together with the traveller’s age, experience price, length of travel, vacation spot, and the volume of coverage preferred. It’s really helpful to shop round and evaluate quotes from different coverage companies to locate the pleasant price to your wishes.

Does journey cancellation insurance cover pre-present clinical conditions?

Some experience cancellation coverage guidelines may additionally offer insurance for pre-existing scientific conditions if certain criteria are met, including shopping the coverage within a targeted time frame after reserving your journey or meeting different eligibility requirements. It’s vital to review the coverage terms and conditions for particular information.